An ICT Order Block represents a change in the market’s delivery state, typically identified by specific candle formations. It’s not simply any up-close or down-close candle but rather has distinct properties:

What are ICT Order Blocks?

ICT order blocks are defined as the last upclosing or downclosing candle before the price shows aggressive movement.

Properties of Order Block

- Order blocks are time-sensitive.

- The highest probability order blocks form inside liquidity pools with a Fair Value Gap (FVG).

- They often form at higher timeframe key levels and can confirm a Change in State of Delivery (CSD)

- They’re characterized by how price responds to them – valid order blocks show price being “in a hurry” to move away, changing its delivery state.

How to Find Order Blocks?

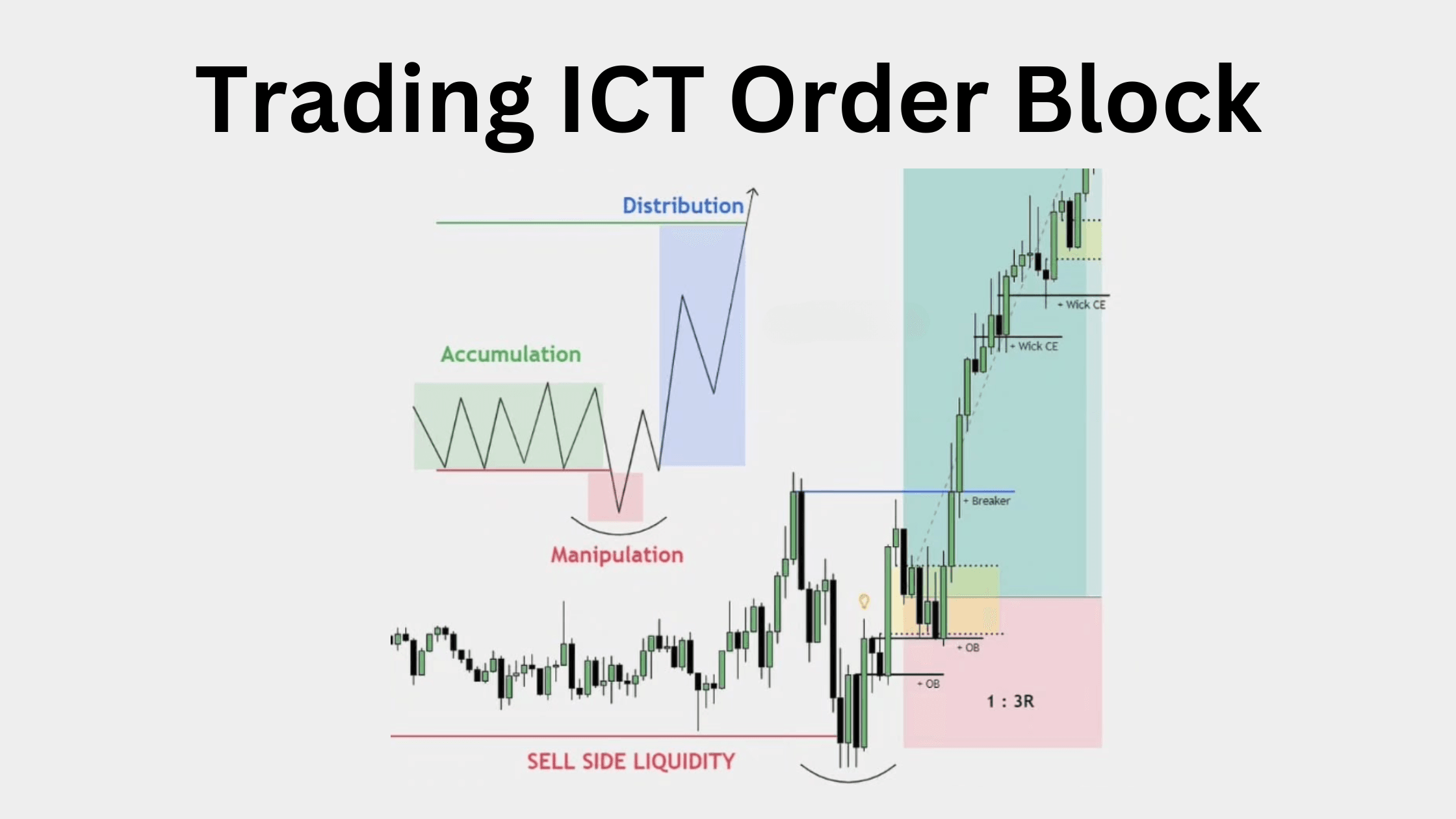

One of the easiest ways to find an order block is to look for a pattern in the market. First, you’ll often see the market moving sideways — this is called a “consolidation.” It means that buyers and sellers are in balance, and the price is staying in a tight range without moving strongly up or down.

But this balance doesn’t last forever. Eventually, either the buyers or the sellers take control and push the price sharply in one direction. This is called an “impulsive move.”

To find the order block, look at the candles just before that strong move.

- If the market moves up strongly, find the last red (bearish) candle before the move — this is your bullish order block.

- If the market moves down strongly, find the last green (bullish) candle before the drop — this is your bearish order block.

These order blocks are important because price often comes back to these areas before continuing in the same direction. Traders use them to plan entries, stop-losses, and targets.

Order Blocks vs Conventional Supply/Demand Zones

| Feature | ICT Order Blocks | Conventional Zones |

|---|---|---|

| Formation | Narrow-range consolidation | Broader zones over 2-3 candles |

| Frequency | Less frequent | More common |

| Impact | Highly influential due to institutional activity | Moderate influence |

What is a Bullish Order Block?

A Bullish Order Block is a price area on the chart where large buyers, such as banks and institutions, entered the market before a strong upward move. It usually forms after a period of consolidation, where the price moves sideways and buyers and sellers are in balance.

The bullish order block is identified by the last down-closing candle (red candle) just before the price breaks out and moves up strongly. This candle marks the zone where big buyers stepped in and took control, often causing the price to rise from that level.

What is A Bearish ICT Order Block?

A Bearish Order Block is a price area on the chart where large sellers, such as banks and institutions, entered the market before a strong downward move. It usually appears after a period of consolidation, where the price moves sideways and there is a temporary balance between buyers and sellers.

The bearish ict order block is identified by the last up-closing candle (green candle) just before the price drops sharply. This candle marks the zone where big sellers stepped in and took control, often causing the price to fall from that level.

Order Block Trading Strategy

- Mark the Consolidation Zone:

Start by identifying areas on the chart where the price is moving sideways. This is called consolidation, and it shows that buyers and sellers are in balance. - Wait for an Impulsive Move:

After consolidation, watch for a strong and sudden price movement in one direction. This shows that either buyers or sellers have taken control of the market. - Look for Break of Structure (BOS):

The impulsive move should break a previous high or low, which confirms a break of market structure and signals a possible trend change or continuation. - Identify the Order Block and Fair Value Gap (FVG):

The strong move usually leaves behind a Fair Value Gap (a gap between candles where no trading occurred). These zones act as potential entry points when the price returns to them. - Trade in the Kill Zone:

Enter trades during high-probability times like the London or New York Kill Zone. These are specific times in the trading day when large moves often happen, increasing your chances of success.

What is a Rejection Block?

A Rejection Block is a special type of order block that forms when price creates wicks at the highs or lows of candles, often after grabbing liquidity. It shows a strong reaction or rejection from a certain price level, usually caused by big players in the market.

In a bearish rejection block, look for wicks on the top of candles, especially after a price spike that takes out recent highs (liquidity grab), followed by a strong drop.

In a bullish rejection block, look for wicks on the bottom of candles, especially after price dips below recent lows (liquidity run), then reverses and moves higher.

These blocks often form at the end of a move, right before a reversal or during a distribution or accumulation phase.

How To Use Rejection Block In Trading

- Treat rejection blocks like regular order blocks — mark them as potential areas where price might react.

- Use them more as a reference point rather than a direct entry signal.

Here’s a simplified and clear explanation of Propulsion Blocks using an informative and beginner-friendly style:

What is a Propulsion Block?

A Propulsion Block is one of the most powerful and favored types of order blocks. The key feature that makes them special is the speed of price movement, which is why they are often referred to as propulsion.

How Does a Propulsion Block Form?

- Opposing Liquidity Run (Ideal Situation):

Propulsion blocks typically form after a liquidity run, where price quickly moves to grab stop-losses or liquidates orders. This could be a spike in price, either up or down, to take out previous highs or lows. - Creation of the Order Block:

After the liquidity run, price creates an order block — a zone where institutions likely entered. This is usually followed by a strong move in the opposite direction (up or down). - The Propulsion Block:

The next down-closing candle (if the market moves up) forms the propulsion block. Price will often return to this block, and the ideal areas to watch are the high of the block and its mean threshold. These levels act as key zones for entry. - Repelling Movement:

Once price returns to the propulsion block, it typically repels away from the area, continuing the strong trend in the opposite direction.

Why It’s Important:

Propulsion blocks are strong signals because of the speed of the move that follows them. They are great for finding high-probability entry points after a strong market move and can often provide solid risk-to-reward setups.

What is a Vacuum Block?

A Vacuum Block is a type of order block that typically forms after a gap up or down in price, often caused by a highly manipulated news event. These gaps create a “vacuum” of liquidity, meaning there’s little to no price action in that area due to the event’s impact.

How Does a Vacuum Block Form?

- News Event Impact:

Vacuum blocks usually form after major news events like the FOMC, CPI, or NFP, which cause a significant move in the market, leading to a price gap. This gap is created because the news has affected the market so quickly that there’s no liquidity or trading activity in that price range. - The Liquidity Gap:

The gap left behind by the news event is often called a “vacuum” because there’s little price action in that area. This creates an imbalance in the market where order

Download Order Block Strategy In PDF

By clicking on the download button, you can download the complete ict order block trading strategy in pdf.