The ICT Venom Trading Model is a sophisticated and precise trading methodology designed to capitalize on liquidity manipulation by institutional players. This model, developed as part of the Inner Circle Trader (ICT) framework, focuses on identifying key reversal points in the market by leveraging inefficiencies and liquidity gaps. Timing plays a critical role in this model, making it a powerful tool for traders who understand how to align their strategies with institutional behaviors.

In this blog post, we’ll explore the core principles of the ICT Venom Model with an emphasis on its time-related elements, including how to identify optimal trading windows and avoid unfavorable conditions.

How to trade the ICT Venom Model?

At its core, the ICT Venom Trading Model revolves around institutional liquidity manipulation. Institutions often target areas of high liquidity, such as stop-loss levels placed by retail traders, to create sharp price movements. The Venom Model seeks to exploit these movements by identifying key reference points and inefficient price runs into and out of these areas.

What is the ICT Venom Trading Model?

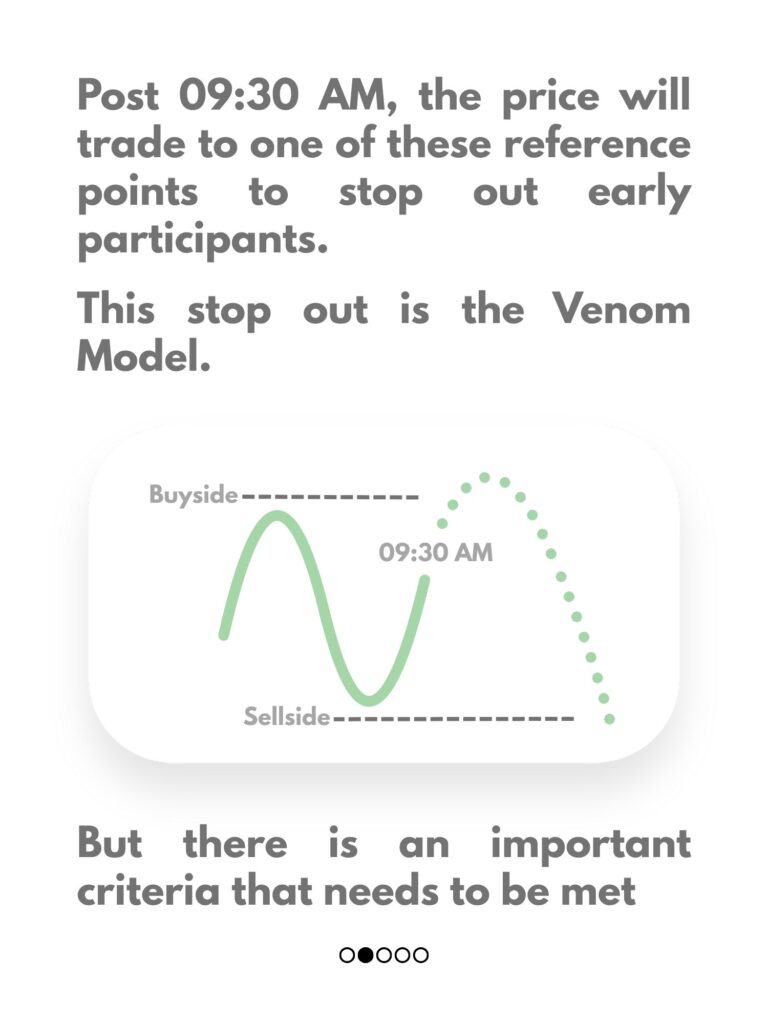

According to ICT, the Venom Model is the highest form of reversal pattern. The underlying premise is that institutions will “stop out” profitable retail traders by driving prices toward liquidity pools (buy-side or sell-side) before reversing in the intended direction.

What is The Best Time For the Venom Trading Model?

Timing is a crucial element of the ICT Venom Model, as it relies on specific market behaviors during well-defined periods. Below are the key timing considerations for implementing this model effectively:

Post-9:30 AM Liquidity Runs

- After 9:30 AM (New York session open), the price typically trades to one of the reference points to stop out early participants.

- Following this liquidity grab, the price often reverses sharply, creating an ideal entry point for traders using the Venom Model.

If the weekly draw direction is clear, traders should frame the buy-side/sell-side (initial reference) with that direction in mind

What Is the Trading Strategy for the ICT Venom Model?

For a trade setup to qualify under the ICT Venom Model, several conditions must be met:

- Inefficient Run into Reference Points

- As depicted in the images, there needs to be an inefficient run into and out of a reference point for it to be a Venom setup. This inefficiency signals institutional activity and increases the likelihood of a reversal.

- Clear Reversal Pattern

- The reversal pattern itself is characterized by sharp price movements away from the reference point after liquidity has been taken.

When Should You Not Use the ICT Venom Trading Model?

While the Venom Model is highly effective under optimal conditions, there are scenarios where it may not work as intended:

- Middle-of-the-Range Price Action

- The Venom Model won’t appear in the middle of the range after several large candles.

- Lack of Predisposition

- The market needs to be predisposed to one direction.

- Failure to Reach Anticipated Levels

- Sometimes, the price won’t go to the anticipated high/low and starts running towards the draw. In such instances, traders can trade the opening range, consequent encroachment, or silver bullet.