Are you tired of guessing where the market might turn next? Ever wondered how professional traders seem to predict key price levels with precision? The secret lies in understanding the ICT Premium Discount (PD) array matric and how they relate to bullish and bearish blocks.

Don’t worry if these terms sound complicated – we’re breaking it all down in simple terms to help you make sense of the charts and trade with confidence.

What is ICT PD Array Matrix?

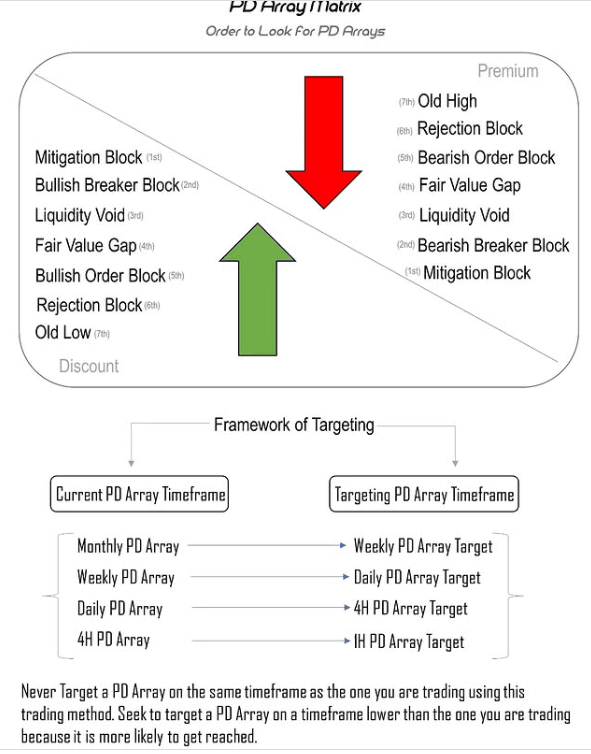

The ICT PD Array Matrix is a framework that organizes and prioritizes premium and discount zones across multiple timeframes, such as monthly, weekly, daily, and intraday charts. It helps traders identify how these zones interact and influence price movements, providing a structured approach to predicting market direction based on the alignment of order blocks, liquidity voids, and fair value gaps across different timeframes.

Think of premium and discount zones as a multidimensional array. In this matrix, multiple PD arrays combine and interact, collectively influencing market behavior. For example, the way monthly or weekly discount zones impact daily discount zones can provide valuable insights into price movements. By mastering these PD arrays, you can uncover the true direction of the market with greater accuracy.

Imagine a scenario where the price is bearish on a 4-hour or daily timeframe, and a weekly order block is present within the discount zone. Understanding this relationship allows you to confidently execute a short position, anticipating that the price will move toward the weekly order block. By leveraging these PD arrays, you can piece together a comprehensive view of how the market operates, giving you a strategic edge in your trading decisions.

What Is ICT Premium Discount (PD)?

The ICT Premium Discount concept is a powerful trading tool that helps traders divide a price range into two key areas:

- Premium Zone: This is the upper half of a price range, where prices are considered expensive. Sellers often dominate this zone, as it’s a good area to look for sell opportunities.

- Discount Zone: This is the lower half of the price range, where prices are considered cheap. Buyers are more likely to step in here, making it an ideal area to look for buy opportunities.

These zones are crucial because they reflect where the big players (institutions or “smart money”) might enter or exit trades.

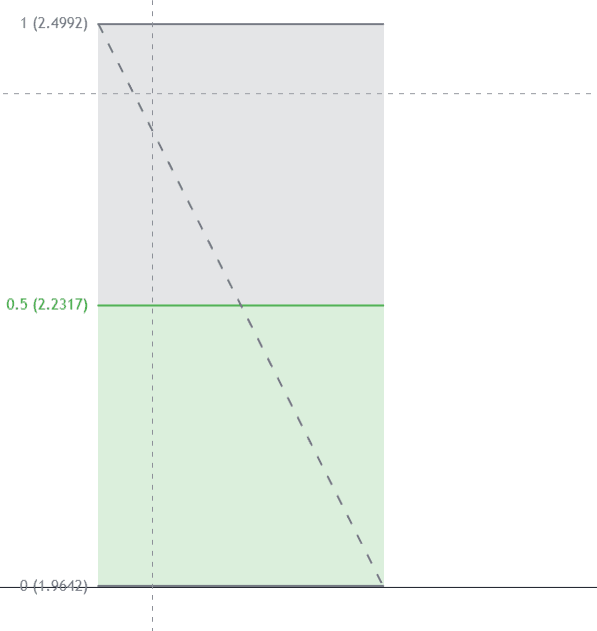

How to Identify Premium and Discount Zones

- Find the Range:

- In a downtrend: Draw a line from the swing high to the swing low.

- In an uptrend: Draw a line from the swing low to the swing high.

- Divide the Range:

- Use a Fibonacci retracement tool and mark the 50% level. This line separates the range into two zones:

- Above 50%: Premium Zone.

- Below 50%: Discount Zone.

- Use a Fibonacci retracement tool and mark the 50% level. This line separates the range into two zones:

What is the ICT PD array hierarchy ?

| Current PD Array | Target PD Array | Hierarchy Level |

|---|

| Monthly PD Array | Weekly PD Array | Higher → Lower |

| Weekly PD Array | Daily PD Array | Higher → Lower |

| Daily PD Array | 4H PD Array | Higher → Lower |

| 4H PD Array | 1H PD Array | Higher → Lower |

| 1H PD Array | Sub-Hourly (e.g., 15min) | Higher → Lower |

What are Bullish PD Array Matrix?

Arrays present below the 50% of fib level are consider as bullish pd arrays. They include

- Bullish Fair Value Gap

- Bullish Breaker Block

- Bullish Order Block

- Bullish Rejection Block

- Bullish Purpulsion Block

- Bullish OTE Levels

What are Bearish PD Array Matrix

Arrays above 50% of fib level are considered bearish pd arrays. These are used for finding short opportunities.

- Bearish OrderBlocks

- Bearish FVG

- Bearish BB

- Bearish OTE