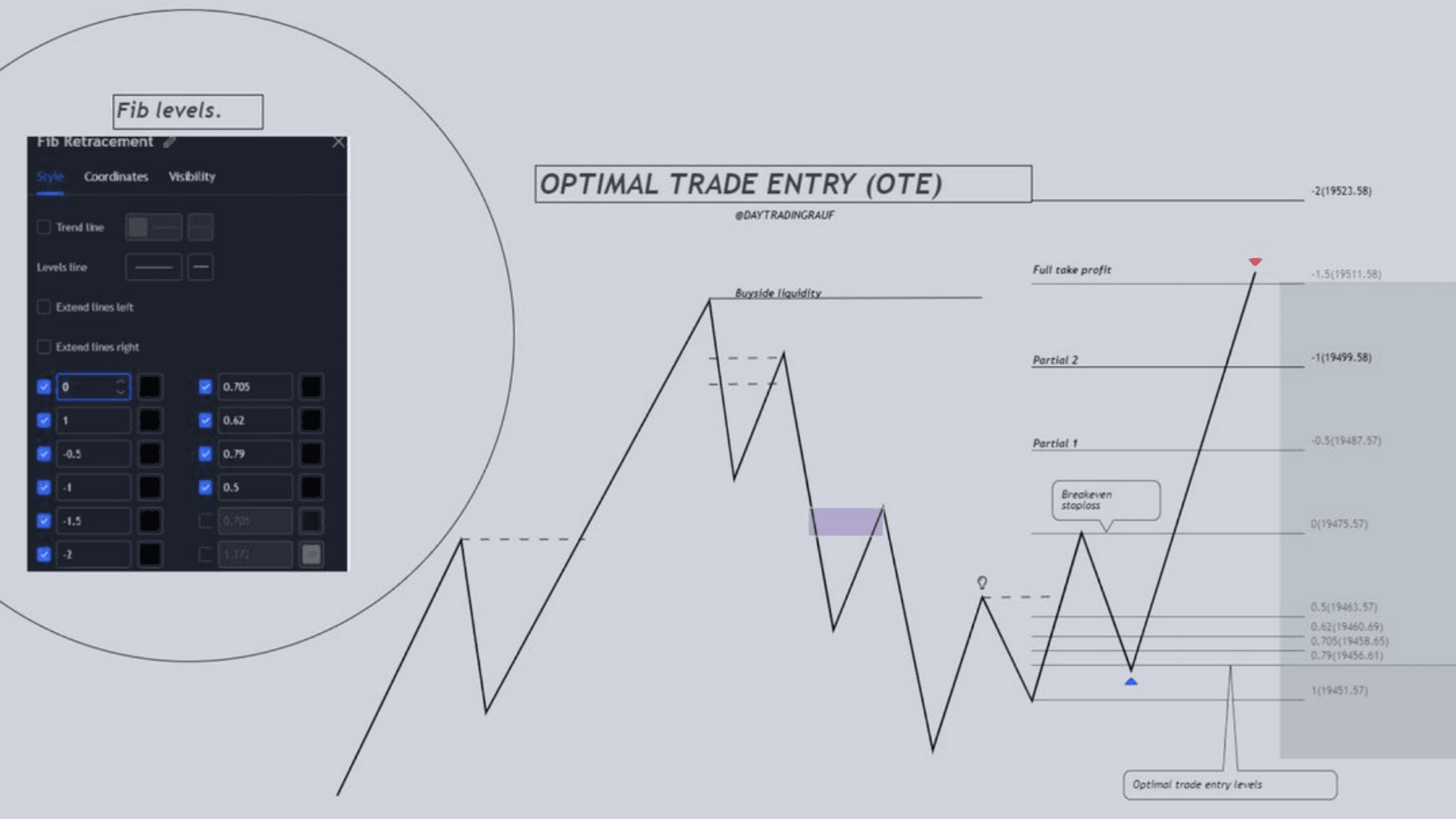

Optimal Trade Entry (ICT OTE) refers to Fibonacci retracement levels traders use to enter long or short positions. These levels, calculated using Fibonacci ratios (e.g., 61.8%, 50%, and 38.2%), help identify strategic price points in a trending market. Markets exhibit cyclical behavior, alternating between upward (bullish) and downward (bearish) movements. Why Are Fibonacci Levels Important in a Trending Market? ICT Bullish OTE Example The below EURUSD chart explain the EURUSD Bullish OTE setup. In a bullish trend, the EUR/USD pair showed significant upward momentum by breaking the previous high at…

Read MoreDay: December 2, 2024

What is CRT in ICT Trading? Candle Range Theory Explained with Strategy, Timing & PDF Guide

Candle Range Theory (CRT) is a trading concept that analyzes market movements within the price ranges of candlesticks. It is beneficial for understanding price action across different timeframes and identifying optimal trade setups. To refine trading strategies, CRT combines technical analysis principles, such as liquidity, accumulation, manipulation, and distribution phases. What is the ICT Candle Range Theory? Inner Circle Trader Candle Range Theory ICT CRT is a trading methodology centered on analyzing candlestick ranges to interpret price dynamics in financial markets. It examines the interaction between the high, low, open,…

Read MoreICT Core Content Notes – Month 1, 2, 3, 4, 5 & All 12 Months PDF Free Download

Welcome! If you’re looking to download comprehensive ICT Core Content notes in PDF format, you’ve come to the right place. I have compiled a set of concise and well-organized notes that cover all the essential topics from the ICT 20216 mentorship program. ICT Core Content Month 1 Notes ICT in the first month of 2016 mentorship teaches elements of trade setup. Basically teaches how price moves and completes its cycle. What is Expansion? Expansion occurs when the price rapidly moves away from a level of equilibrium (50% of fib), indicating…

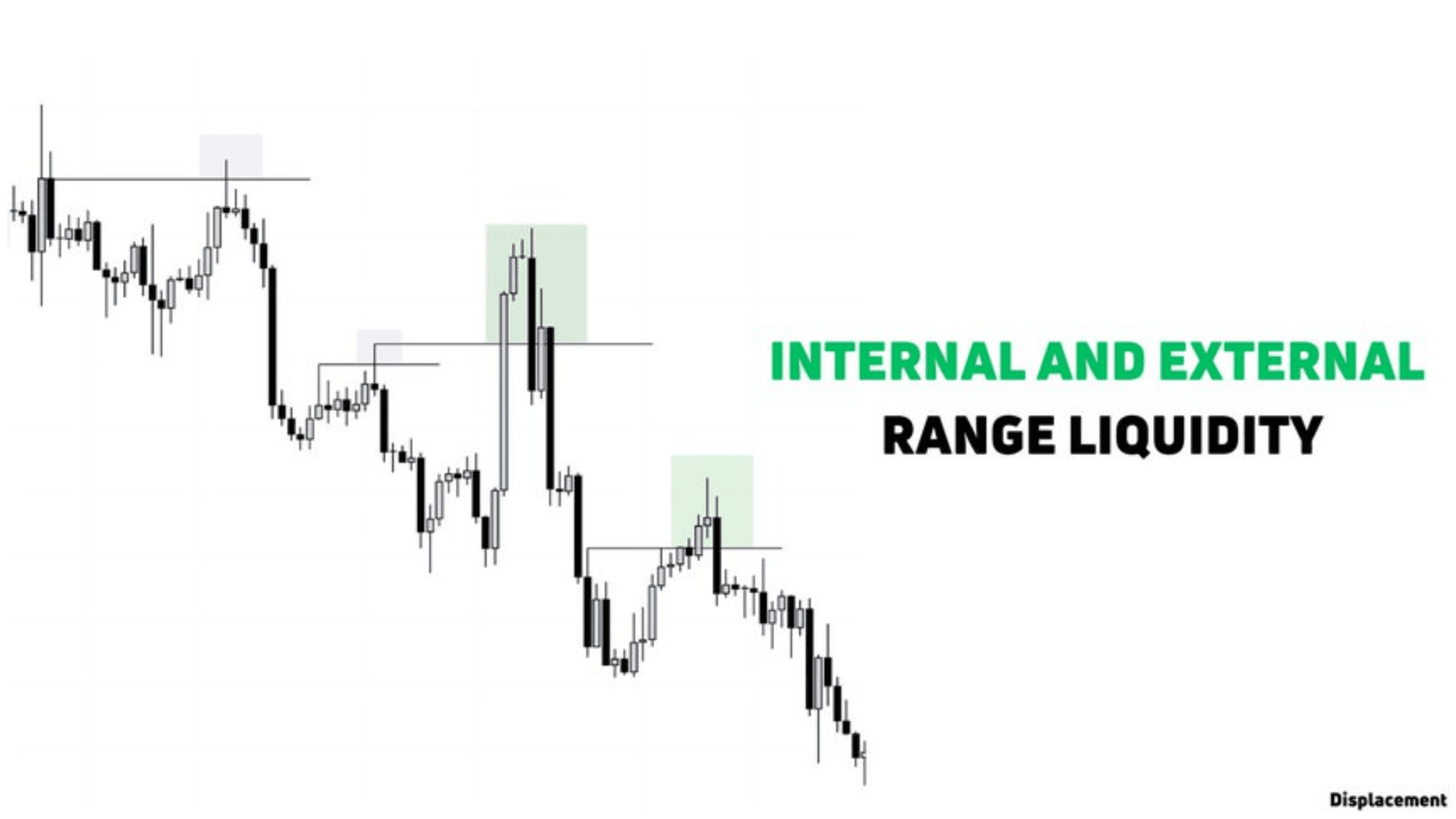

Read MoreICT Internal Range Liquidity and External Range Liquidity (IRL&ERL)

Internal Range Liquidity (IRL) and External Range Liquidity (ERL) are cornerstone concepts in building a trading framework based on ICT (Inner Circle Trader) liquidity principles. These concepts offer a comprehensive understanding of market dynamics by revealing where price originates and its likely destination. Understanding IRL and ERL allows traders to map the flow of price action systematically. When the market sweeps External Range Liquidity—the liquidity resting above swing highs or below swing lows—it often targets Internal Range Liquidity zones next, such as order blocks or fair value gaps. Similarly, after…

Read MoreICT Liquidity Trading Concept 101: A Simple Guide for Beginners

When it comes to trading, the single objective of smart money (big players) in the market is to make a profit by hunting liquidity. This is one of the most important concepts to understand in trading. As a retail trader with limited capital, it’s crucial to grasp how liquidity works and how you can use it to your advantage. In this blog post, I will explain how to make profitable trades using liquidity, the key differences between sell-side and buy-side liquidity, and much more. What is ICT Liquidity In Trading?…

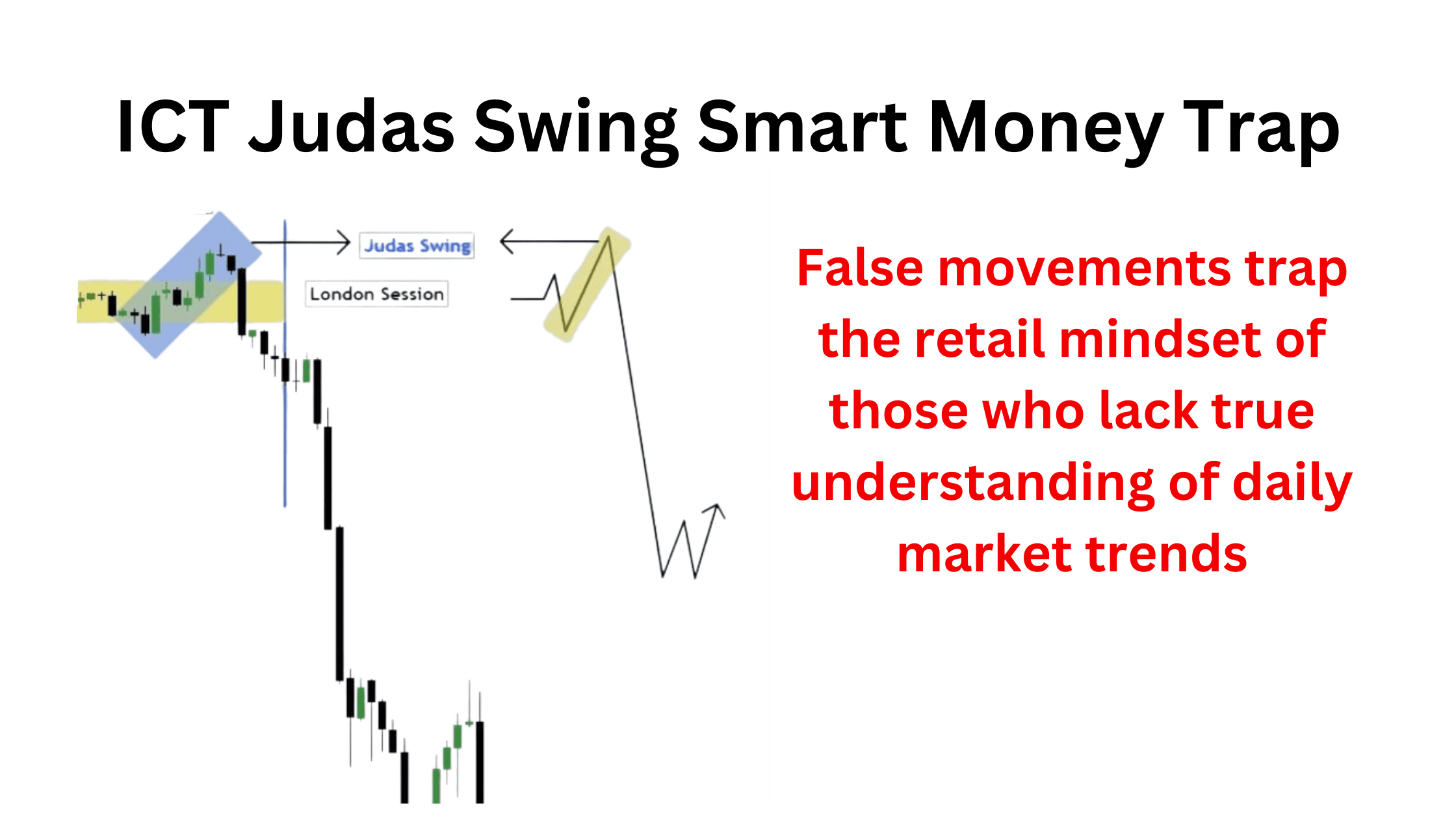

Read MoreMastering ICT Judas Swing Strategy

ICT Judas Swing refers to false market movements that trap retail traders, particularly those who lack a true understanding of daily bias. These deceptive movements often lead to misguided decisions, resulting in losses for traders who are unable to interpret the underlying market conditions accurately. What Is ICT Judas Swing? The Judas Swing is a tactic used by smart money to exploit retail traders who lack an understanding of higher time frame direction. This movement typically occurs from midnight New York local time to 5 AM New York local time.…

Read MoreICT 2024 Mentorship Notes PDF Lecture-1

In the world of trading, time is the cornerstone of every price movement. It’s not just about what the market does, but when it does it. The 2024 ICT Mentorship kicks off by emphasizing that time dictates when and why price makes a significant move, whether it’s a displacement, a run, or a retracement. Lecture-1 Summary ICT Mentorship 2024 Why Time Matters ICT Mentorship 2024 Understanding that price delivers according to time is crucial. Without the element of time, price movements lose their meaning. Time is the foundation upon which…

Read MoreMastering ICT Mentorship 2024: Lecture 2 Breakdown

In this blog post, we dive into the essential concepts covered in Lecture 2 of the ICT Mentorship 2024 program, focusing on post-7:00 AM price delivery and understanding how to anticipate market movements. By concentrating on key principles such as liquidity hunts, Fair Value Gaps (FVGs), and breaker blocks, this session arms traders with the tools needed to navigate the volatile morning markets effectively. Important Topics of Lecture 2 ICT 2024 Mentorship Program Why the 7:00 AM Line Matters The lesson begins by stressing the importance of the 7:00 AM…

Read MoreMastering the ICT New Day Opening Gap (NDOG): A Complete Strategy Guide

If you’re exploring advanced trading concepts, understanding the ICT New Day Opening Gap (NDOG) can significantly improve your trading precision. In this guide, we’ll break down what an NDOG is, how to identify it on your chart, and how to trade it effectively using the ICT NDOG strategy. What is the ICT New Day Opening Gap? The ICT New Day Opening Gap refers to the price gap created between the market’s closing price at 5:00 PM (New York time) and the opening price at 6:00 PM (New York time) from…

Read More