The ICT Power of 3 (PO3) trading strategy, developed by Michael Huddleston, provides a unique perspective on market dynamics. By analyzing how institutional investors, often referred to as “smart money,” operate, this strategy offers retail traders an edge in understanding price movements.

The core concept revolves around three distinct phases of market behavior: Accumulation, Manipulation, and Distribution (AMD). Mastering these phases enables traders to anticipate price action and align their trades with institutional strategies.

What is ICT accumulation manipulation distribution

ICT defined the Accumulation Manipulation and Distribution concept as a power of 3 (PO3) concept. How smart money manipulates the psychology of retail traders and trap them.

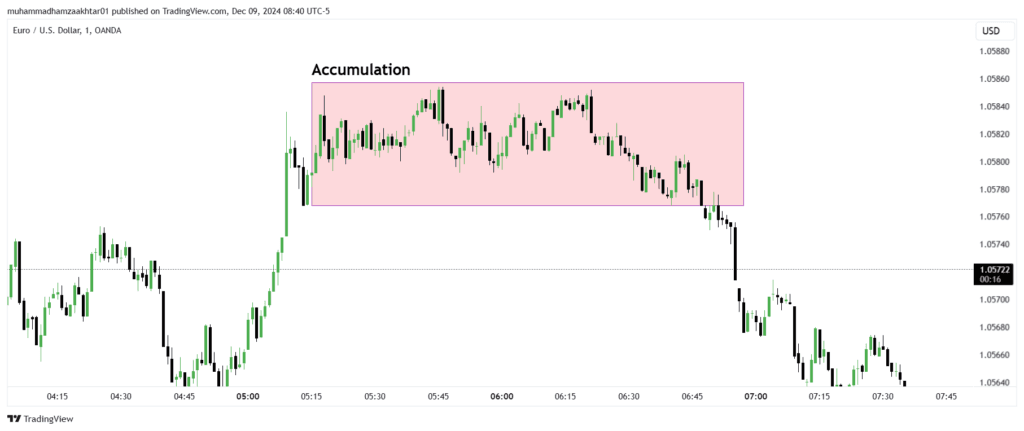

What is Accumulation?

The Accumulation phase is the first part of the power of 3 ict trading strategy, where smart money (large institutional investors) quietly builds both buy and sell positions. They do this carefully to avoid drawing attention.

During this phase, prices move within a narrow range and don’t show much volatility. The market seems uncertain, with no clear trend. In accumulation phase price is moves in a tight range.

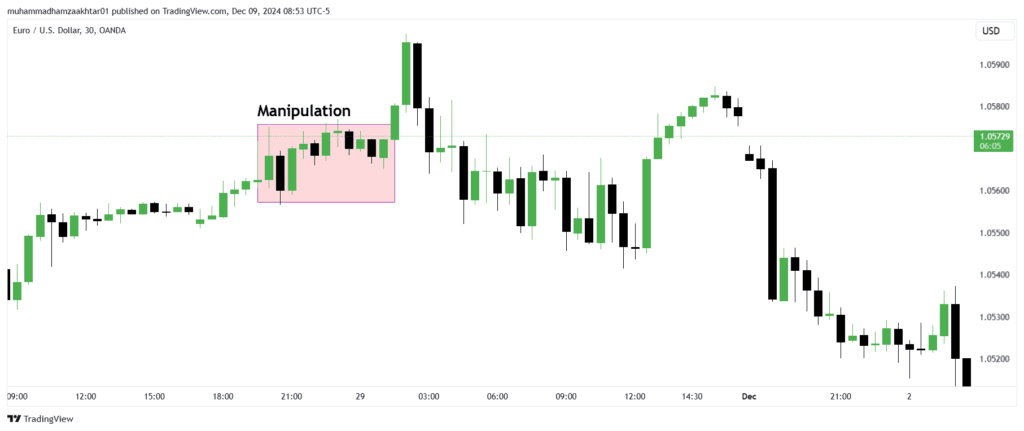

What is Manipulation?

The Manipulation phase is where the strategy gets its name from. During this phase, institutional investors actively influence price action to create liquidity. This involves triggering stop-loss orders and fooling retail traders into making incorrect decisions.

Stop-Loss Hunting: Prices are deliberately pushed to levels where retail traders commonly place stop-loss orders, such as:

- Previous day’s highs and lows.

- Equal highs or lows, perceived as strong support or resistance levels.

Fake Breakouts: These occur when the price breaches key levels, luring traders into the market before reversing direction.

What is Distribution?

After liquidity is captured, the Distribution phase begins. Here, institutions drive the market decisively in their desired direction, creating the final leg of the ICT Power of 3 strategy.

- Bullish Distribution:

- Accumulation occurs near the opening price or slightly below.

- Manipulation sweeps sell-side liquidity, trapping traders expecting a downtrend.

- Institutions push the price upward in a strong, sustained move.

- Bearish Distribution:

- Accumulation happens near the opening price, followed by a sharp spike above key resistance levels.

- Manipulation tricks traders into buying the breakout, only for the price to reverse sharply downward.

- Institutions sell aggressively, creating a downward trend.

How to Trade the ICT Power of 3

To leverage the ICT Power of Three effectively, traders must align their actions with the phases of Accumulation, Manipulation, and Distribution.

- Establish a Daily Bias:

Begin by analyzing the weekly and monthly trends to determine whether the market is likely to move up or down on a given day. This forms the basis of your trading strategy. - Look for Liquidity Sweeps:

Identify areas where stop-loss orders are likely to be triggered, such as previous highs, lows, or ranges. - Entry Points:

- Use tools like Optimal Trade Entry (OTE) or Fair Value Gaps (FVG) to pinpoint retracement levels during the manipulation phase.

- Enter trades aligned with the anticipated movement during the distribution phase.

- Avoid Counter-Trend Trades:

Stick to the established daily direction to increase the probability of success