ICT Classic Buy Day Template Explained

In the world of trading, spotting high-probability days can dramatically enhance your trading success. Experienced traders use various…

Learn market insights from experts, understanding how the market operates and the forces that drive market movements.

In the world of trading, spotting high-probability days can dramatically enhance your trading success. Experienced traders use various…

CHoCH and BoS are two important concepts in trading. Change of Character (CHoCH) indicates that the market can…

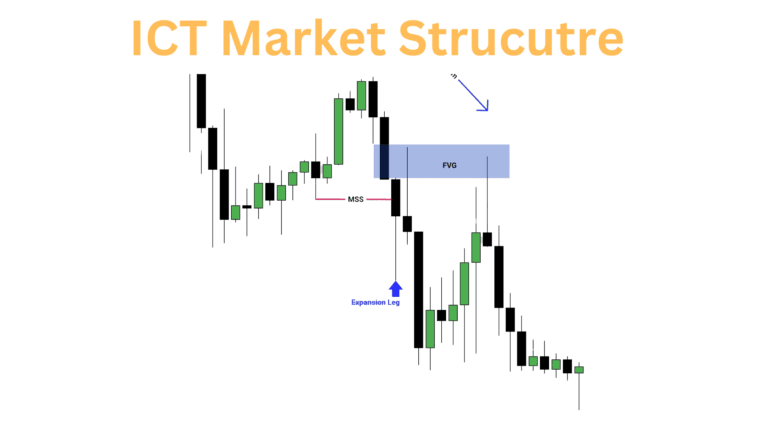

The ICT Market Structure Shifts (MSS) concept is crucial for traders aiming to grasp market trends and make…

ICT Smart Money Technique (SMT) Divergence is a powerful concept that reveals discrepancies between correlated assets, signaling potential…

In ICT (Inner Circle Trading), understanding how price imbalances impact market movements is a valuable skill for traders….

ICT Daily Bias is a critical tool for traders at the start of each week to determine the…

In the world of Inner Circle Trading (ICT), traders use various concepts and strategies to enhance their decision-making…

In the world of Inner Circle Trading (ICT), understanding the concept of Fibonacci levels is crucial for traders…

The ICT Opening Range Gap (ORG) refers to the price difference between today’s market open and yesterday’s close….

The ICT Opening Range is a crucial concept in Inner Circle Trading (ICT), focusing on the first 30…