The ICT Opening Range Gap (ORG) refers to the price difference between today’s market open and yesterday’s close. This gap often acts as a magnet for price action, as the market tends to revisit or partially fill the ORG before making any significant directional move. What is ICT Opening Range Gap (ORG)? The Inner Circle Trader Opening Range Gap (ORG) represents the price difference—or “jump”—between the previous day’s close and the current day’s open during Regular Trading Hours (RTH). Specifically, it’s the gap between: When you switch your chart to…

Read MoreAuthor: muhammadhamza

How To Trade ICT Opening Range Gap (2025)

The ICT Opening Range is a crucial concept in Inner Circle Trading (ICT), focusing on the first 30 to 60 minutes after the market opens. During this period, traders analyze the price action to assess the market’s direction, liquidity, and potential trading opportunities. By understanding the opening range, traders can establish a clearer market bias, leading to more precise trading decisions. What is the ICT Opening Range? The ICT Opening Range focuses on the price action that happens in the first 30 to 60 minutes after a major market opens.…

Read Morejeffrey neumann trader

Jeffrey Neumann has emerged as a prominent figure in the world of Inner Circle Trading (ICT), renowned for his insightful strategies and deep understanding of market mechanics. His approach to ICT offers traders a structured way to navigate complex financial markets by focusing on core elements like market structure, liquidity analysis, and order flow. jeffrey neumann trader Neumann’s methods are especially valuable for those looking to enhance their trading precision and risk management. This article delves into Jeffrey Neumann’s unique trading perspective, explores the key strategies he advocates within ICT,…

Read MoreDisplacement Candle Explained

In the world of trading, especially within the framework of Inner Circle Trading (ICT), understanding various candlestick patterns is crucial for making informed decisions. One such pattern is the displacement candle, a key indicator that can signal significant price movements and potential reversals. Displacement candles are characterized by their ability to reflect sharp price changes within a short period, highlighting shifts in market sentiment and momentum. In this article, we will explore the concept of displacement candles, their significance in ICT, how to identify them, and practical strategies for incorporating…

Read MoreBPR in trading meaning

The Balanced Price Range (BPR) is a crucial concept in ICT (Inner Circle Trading), representing a period where the market finds equilibrium between buyers and sellers. Understanding how price reacts within a BPR zone allows traders to predict potential price moves and make more informed decisions. In this article, we will delve into the meaning of BPR in trading, BPR in trading meaning how it works within ICT strategies, and how you can effectively use it to improve your trade setups. Mastering BPR can help you identify key market turning…

Read MoreLiquidity Sweep-A Trading Guide

In the dynamic world of financial trading, understanding market mechanics is crucial for success. One essential concept that traders must grasp is the liquidity sweep. A liquidity sweep occurs when a large order moves through the market, impacting the price and often leading to significant shifts in market structure. This phenomenon is particularly relevant in Inner Circle Trading (ICT), where liquidity plays a vital role in determining market behavior. By recognizing and utilizing liquidity sweeps, traders can enhance their strategies, identify optimal entry and exit points, and navigate the complexities…

Read MoreSMT Divergence Meaning in Trading

SMT divergence, or Smart Money Technique divergence, is a critical concept in the realm of Inner Circle Trading (ICT) that offers traders valuable insights into market dynamics. At its core, SMT divergence helps identify potential price reversals by analyzing discrepancies between price movements and the corresponding action of market makers. Understanding SMT divergence not only enhances a trader’s ability to predict market trends but also provides a strategic edge when making trading decisions. In this article, we will delve into the meaning of SMT divergence, explore its significance within ICT,…

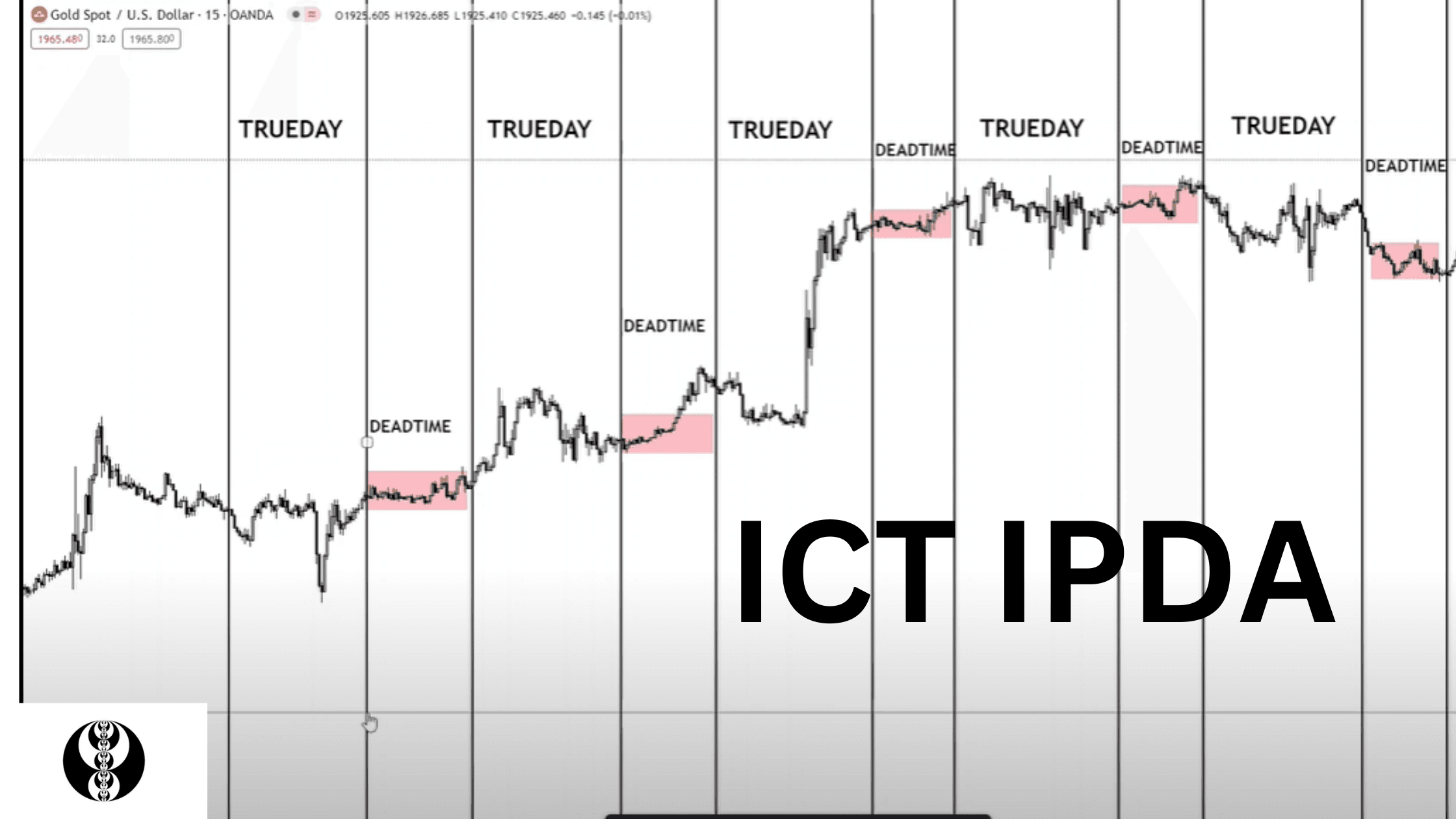

Read MoreWhat is Interbank Price Delivery Algorithm (IPDA) and Data Ranges?

The Interbank Price Delivery Algorithm (IPDA) is a theoretical framework used to understand how institutional markets deliver price by seeking liquidity and rebalancing inefficiencies. It emphasizes the role of liquidity pools (Buy-Side and Sell-Side) and Fair Value Gaps (FVGs) in driving price movements. IPDA helps traders align with institutional order flow for precise market analysis. What is IPDA? The Interbank Price Delivery Algorithm governs how price moves in the financial markets. It’s the backbone of market behavior, dictating the four main phases: What are IPDA Data Ranges? IPDA operates based…

Read MoreNWOG Explained-Key Insights

In the dynamic world of trading, where strategies and techniques constantly evolve, understanding key concepts can make a significant difference in a trader’s success. One such concept is NWOG, which stands for “No Wicks On Gaps.” This term, rooted in the principles of Inner Circle Trading (ICT), refers to a specific market behavior that traders can leverage to optimize their trading strategies. By grasping the nuances of NWOG, traders can better identify entry and exit points, manage risks, and ultimately enhance their overall trading performance. In this article, we will…

Read MoreBuy Side Liquidity in ICT Trading

In the realm of trading, liquidity plays a crucial role in shaping market movements. One specific aspect, buy side liquidity, is particularly significant for traders who use the Inner Circle Trading (ICT) methodology. Buy side liquidity refers to the amount of demand from buyers at various price levels and is vital for understanding market dynamics. This article delves into the concept of buy-side liquidity, its importance in the Forex market, and how it can be utilized effectively within your trading strategies. By understanding these dynamics, you can make more informed…

Read More