The ICT Venom Trading Model is a sophisticated and precise trading methodology designed to capitalize on liquidity manipulation by institutional players. This model, developed as part of the Inner Circle Trader (ICT) framework, focuses on identifying key reversal points in the market by leveraging inefficiencies and liquidity gaps. Timing plays a critical role in this model, making it a powerful tool for traders who understand how to align their strategies with institutional behaviors. In this blog post, we’ll explore the core principles of the ICT Venom Model with an emphasis on its…

Read MoreCategory: ICT Concepts

What is the ICT Macro Time: in London & New York with Examples and Trading Strategies

ICT Macro Time refers to short, strategic windows during the trading day—usually 20 to 30 minutes long—when institutional algorithms are most active. These periods are known for: Traders who understand ICT (Inner Circle Trader) Macro Times can capitalize on sharp price movements and more predictable setups during these intervals. What Is ICT Macro Time? ICT Macro Time is a concept created by the Inner Circle Trader (ICT), which identifies key algorithm-driven times in the market where institutional orders are typically executed. These windows offer traders: What Are ICT Macro Times…

Read MoreWhat is an ICT Fair Value Gap (FVG) in Trading? – Complete Strategy & Examples Download PDF

Fair Value Gap (FVG) is a concept from the Inner Circle Trader (ICT) methodology. It refers to a price imbalance or inefficiency created when the market moves so quickly that it skips over certain price levels. If you’re a price action or smart money concept trader, you’ve probably heard of the Fair Value Gap (FVG). But what exactly is it, and how can you use it to make better trading decisions? This guide explains the ICT Fair Value Gap, how to spot bullish and bearish FVGs, real-world examples, and a…

Read MoreMastering the ICT PD Array Matrix

Are you tired of guessing where the market might turn next? Ever wondered how professional traders seem to predict key price levels with precision? The secret lies in understanding the ICT Premium Discount (PD) array matric and how they relate to bullish and bearish blocks. Don’t worry if these terms sound complicated – we’re breaking it all down in simple terms to help you make sense of the charts and trade with confidence. What is ICT PD Array Matrix? The ICT PD Array Matrix is a framework that organizes and…

Read MoreICT Classic Buy Sell Template

The ICT Classic Buy and Sell Template serves as a reference framework to study market dynamics. By following the signature in the template, you can anticipate whether the market is going up or down. It works across every asset class and timeframe. Basic Components of the ICT Template The concept of Liquidity Drawn serves as the foundation for the ICT Classic Template. Liquidity Drawn refers to areas where price is likely to move in order to sweep liquidity. The primary reason for price movement is to neutralize the positions of…

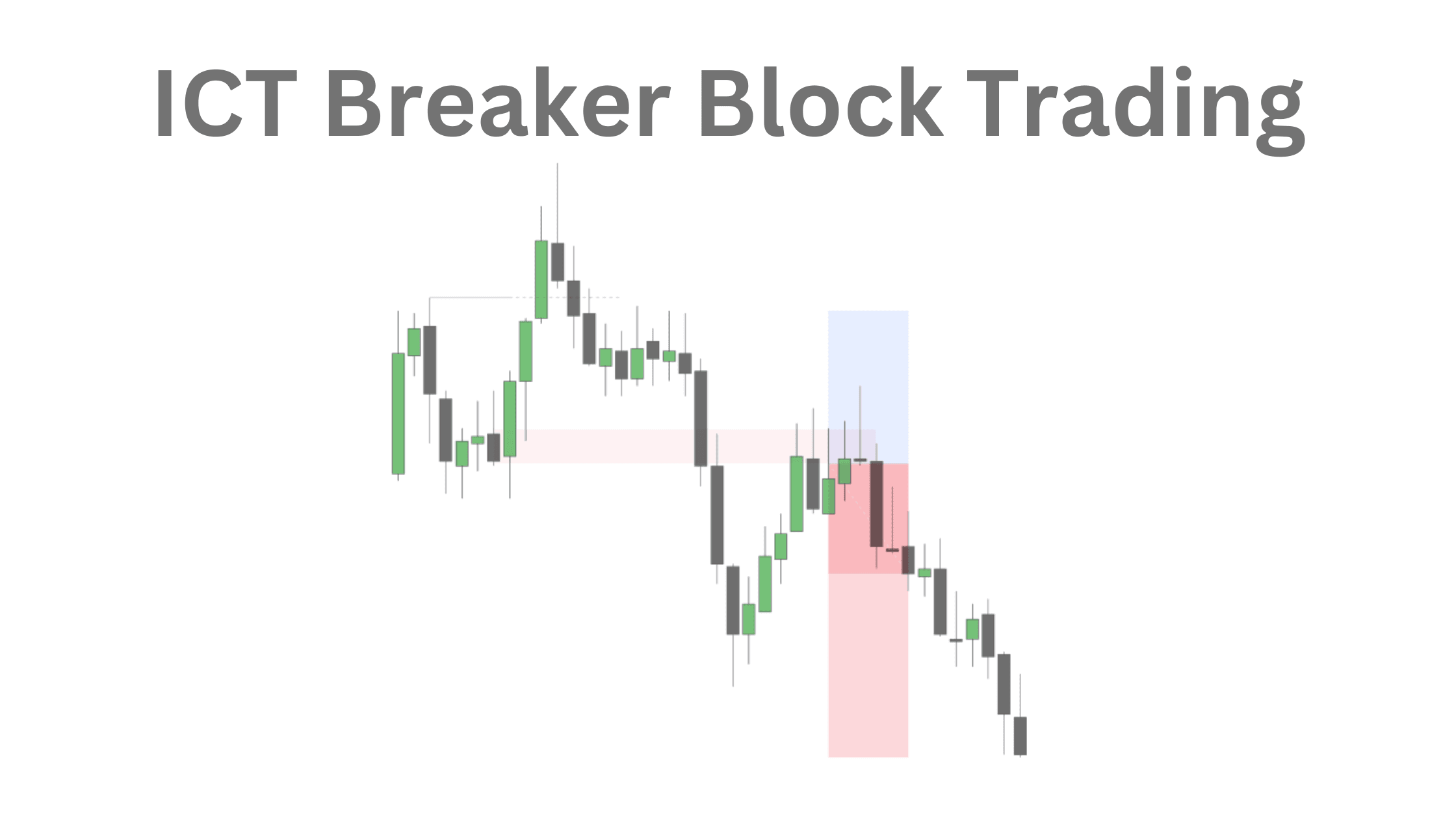

Read MoreICT Breaker Block:Meaning,Example,Trading Strategy

An ICT breaker block is a failed order block that signals a shift in market momentum. It is typically identified after a strong price movement where the market is unable to sustain its direction, resulting in a reversal pattern. This phenomenon highlights a change in market sentiment and provides traders with potential entry or exit signals, making it a valuable tool in technical analysis and smart money trading strategies. What is an ICTBreaker Block in Forex? An ICT breaker block, as defined by the Inner Circle Trader (ICT), is a…

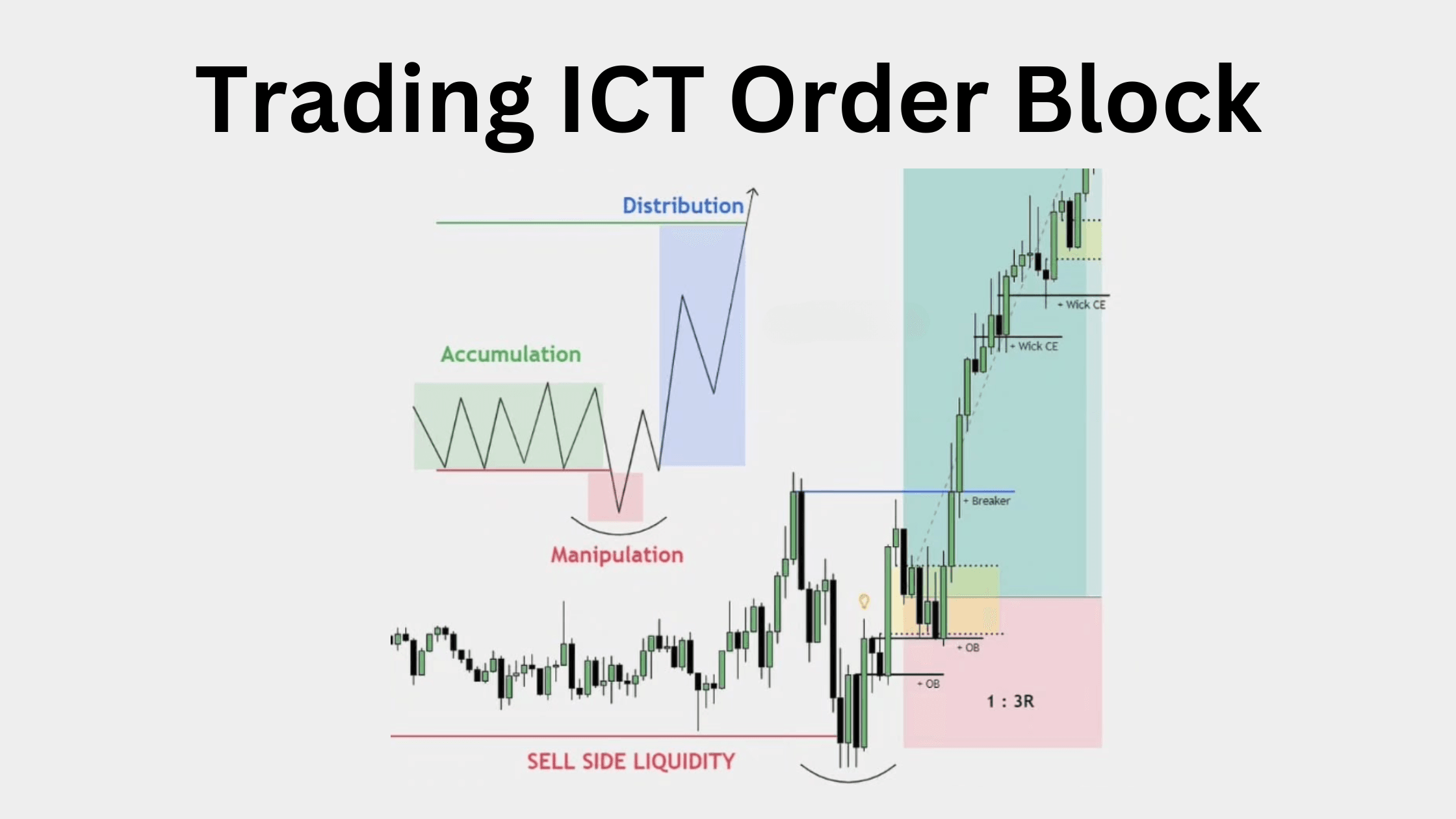

Read MoreICT Reclaimed Order Block Theory: Definition, Examples, Trading Strategy, and Free PDF Download

An ICT Order Block represents a change in the market’s delivery state, typically identified by specific candle formations. It’s not simply any up-close or down-close candle but rather has distinct properties: What are ICT Order Blocks? ICT order blocks are defined as the last upclosing or downclosing candle before the price shows aggressive movement. Properties of Order Block How to Find Order Blocks? One of the easiest ways to find an order block is to look for a pattern in the market. First, you’ll often see the market moving sideways…

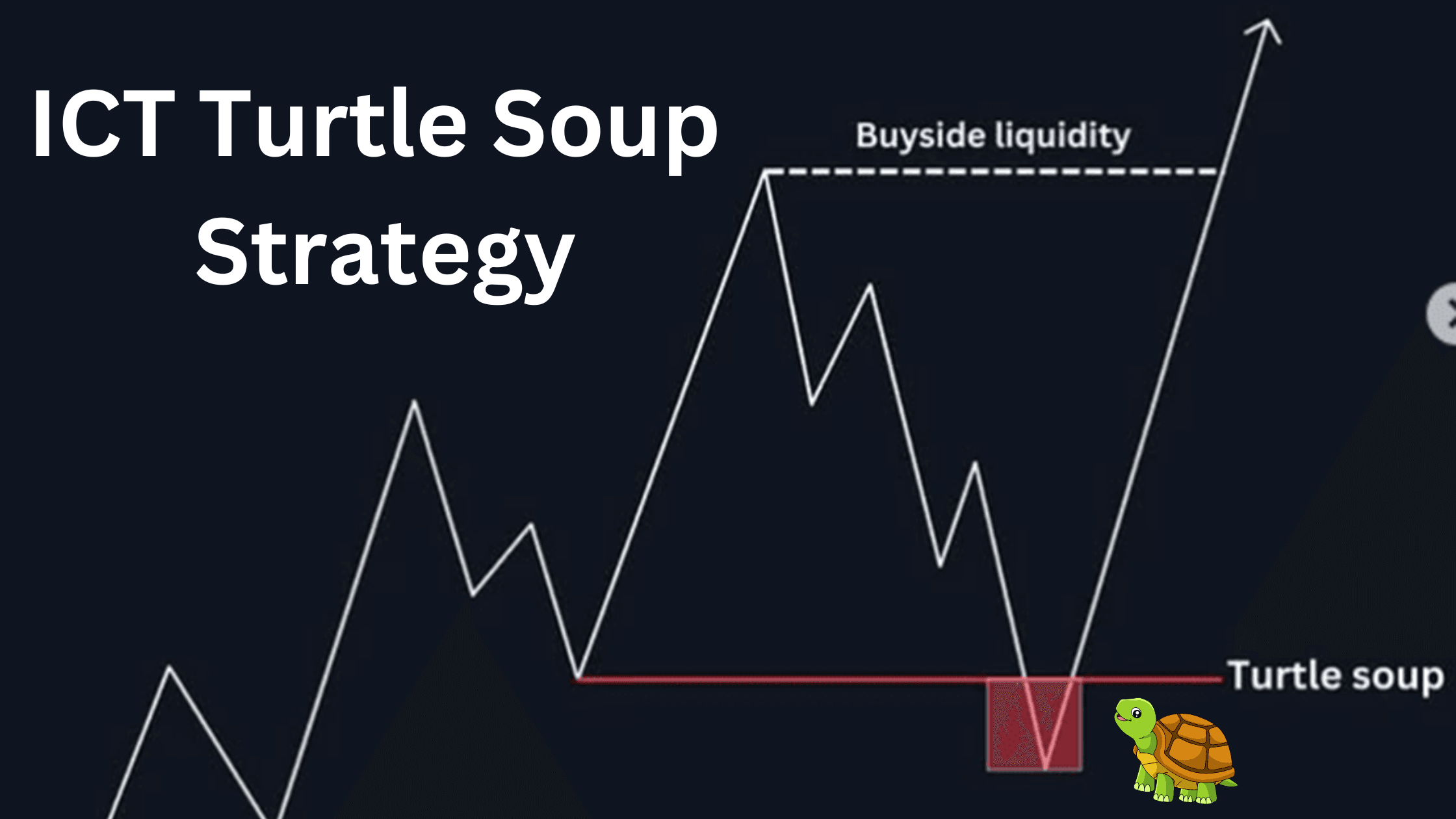

Read MoreMastering the ICT Turtle Soup Trading Strategy: A Comprehensive Guide

The ICT (Inner Circle Trader) Turtle Soup strategy is a renowned trading approach designed to identify and capitalize on false breakouts. By understanding this pattern, traders can enhance their ability to detect liquidity grabs and make informed decisions in the volatile world of financial markets. In this guide, we will explore the Turtle Soup strategy, its application, and tips to maximize its effectiveness. What is the ICT Turtle Soup Pattern? The Turtle Soup pattern is a trading strategy that focuses on false breakouts, also known as liquidity grabs. It identifies…

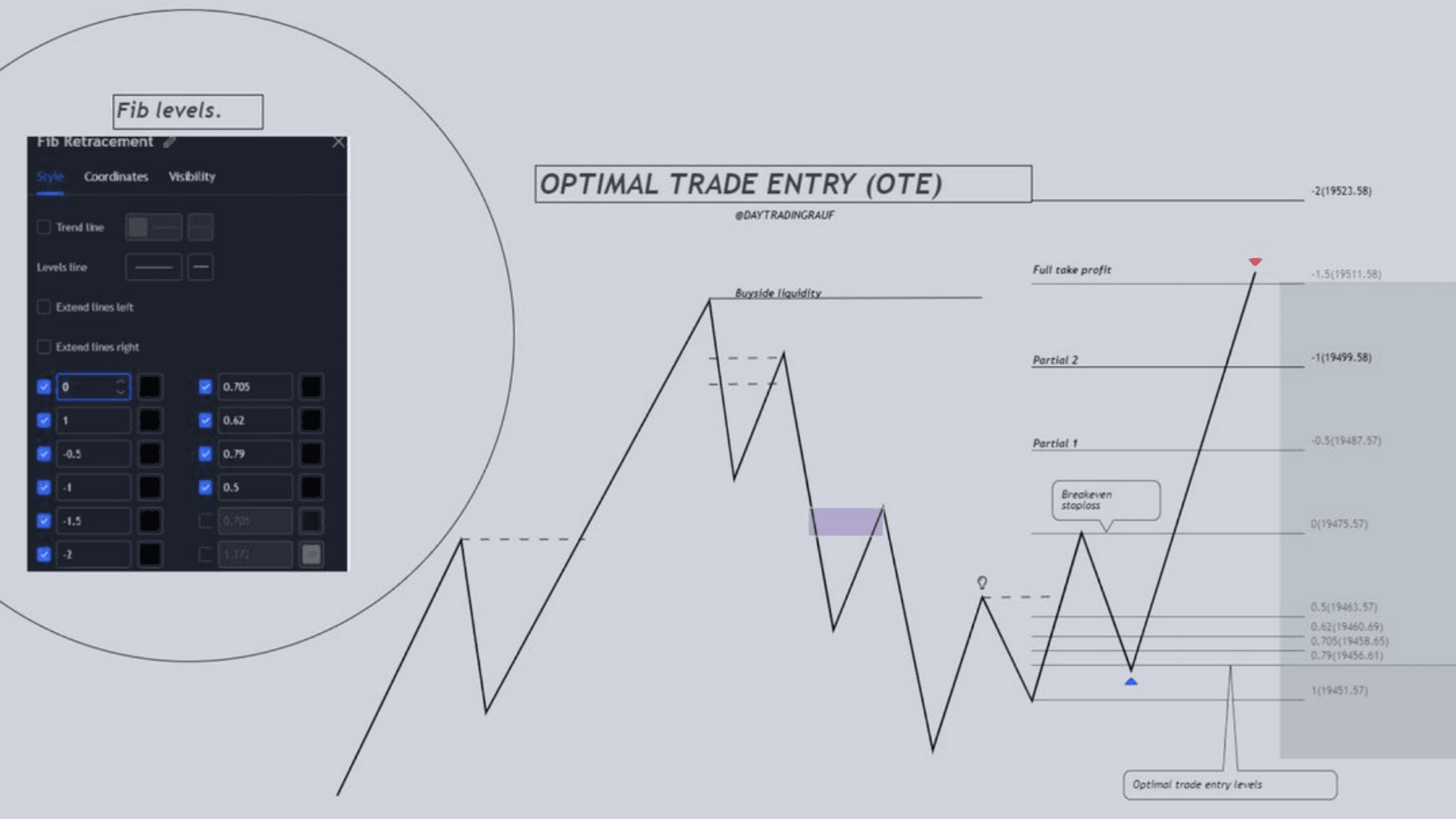

Read MoreICT Optimal Trade Entry (OTE) Fib Levels and Settings

Optimal Trade Entry (ICT OTE) refers to Fibonacci retracement levels traders use to enter long or short positions. These levels, calculated using Fibonacci ratios (e.g., 61.8%, 50%, and 38.2%), help identify strategic price points in a trending market. Markets exhibit cyclical behavior, alternating between upward (bullish) and downward (bearish) movements. Why Are Fibonacci Levels Important in a Trending Market? ICT Bullish OTE Example The below EURUSD chart explain the EURUSD Bullish OTE setup. In a bullish trend, the EUR/USD pair showed significant upward momentum by breaking the previous high at…

Read MoreWhat is CRT in ICT Trading? Candle Range Theory Explained with Strategy, Timing & PDF Guide

Candle Range Theory (CRT) is a trading concept that analyzes market movements within the price ranges of candlesticks. It is beneficial for understanding price action across different timeframes and identifying optimal trade setups. To refine trading strategies, CRT combines technical analysis principles, such as liquidity, accumulation, manipulation, and distribution phases. What is the ICT Candle Range Theory? Inner Circle Trader Candle Range Theory ICT CRT is a trading methodology centered on analyzing candlestick ranges to interpret price dynamics in financial markets. It examines the interaction between the high, low, open,…

Read More