ICT Kill Zones are critical windows for intraday traders. During these times, major market sessions overlap, increasing volatility and creating high-probability trading setups. For scalpers, these sessions offer opportunities to capture quick moves of 15 to 30 pips on major currency pairs. Trading during ICT Kill Zones gives you a significant edge. You can enhance your strategy even further by combining Kill Zone timing with ICT’s Power of Three and liquidity concepts, allowing for smarter entries, exits, and overall trade management. What is ICT Kill Zone In Forex Trading? ICT…

Read MoreCategory: ICT Concepts

CHOCH vs BOS-Trading Concepts

In the world of Inner Circle Trading (ICT), understanding key concepts like Change of Character (CHOCH) and Break of Structure (BOS) is essential for success. These choch vs bos are foundational in recognizing market structure and making informed trading decisions. CHOCH signals potential trend reversals, while BOS confirms trend continuations. This article will delve into these concepts, providing in-depth explanations and practical examples to help traders incorporate them into their strategies. What is CHOCH? Change of Character (CHOCH) is a key concept in ICT trading that helps traders identify potential…

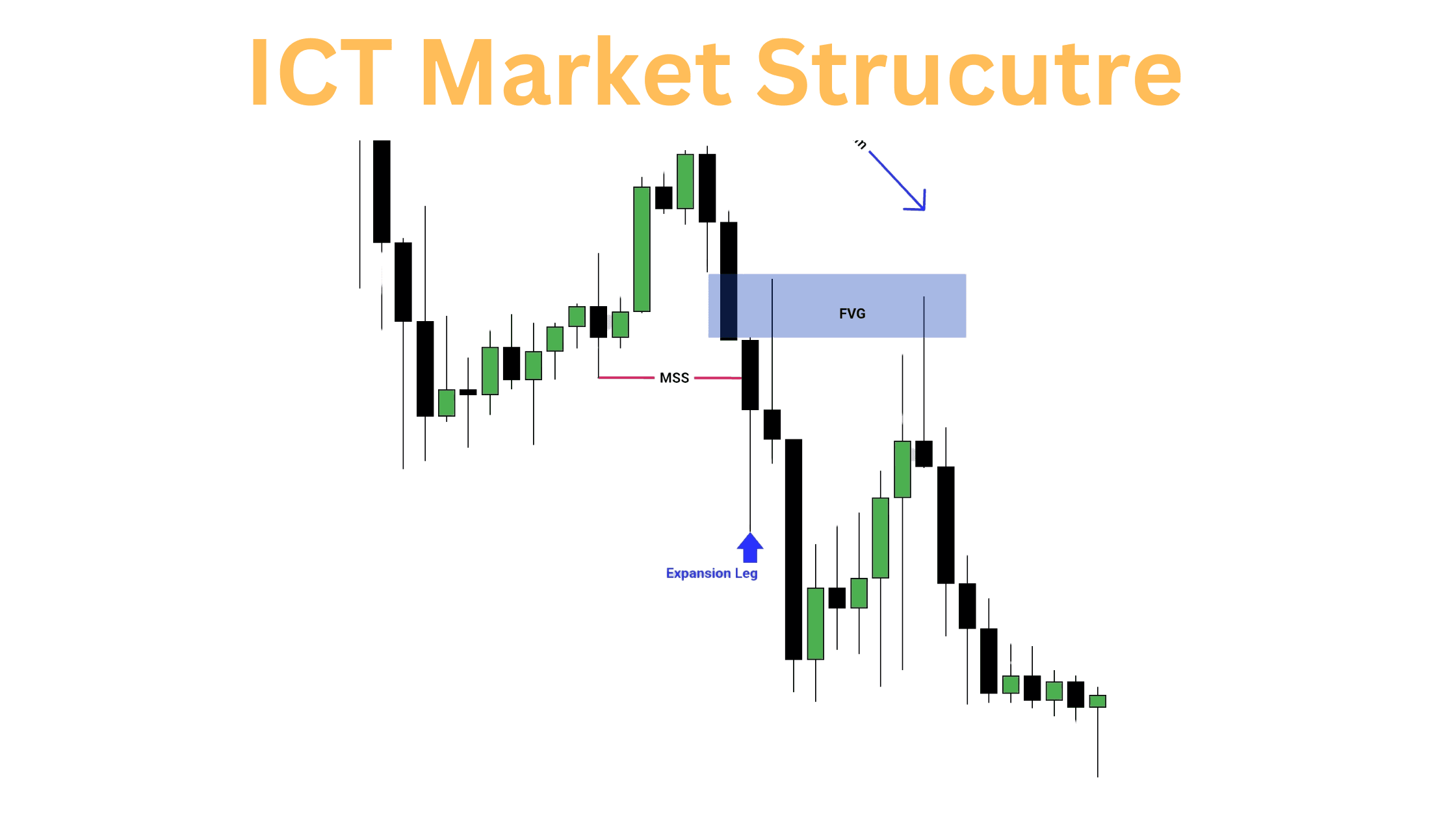

Read MoreWhat is ICT Market Structure Shift (MSS)? Explained

The ICT Market Structure Shifts (MSS) concept is crucial for traders aiming to grasp market trends and make informed decisions. By understanding MSS, traders can identify turning points in the market, determine trend direction, and enhance their trading strategies What is ICT Market Structure Shift (MSS)? A Market Structure Shift (MSS) signifies a change in the market’s established pattern, often pointing to a trend reversal. In ICT trading, an MSS occurs when the price breaks a previous higher high (HH) or lower low (LL), signaling a potential shift in the…

Read MoreLondon Kill Zone Trading Strategy

In the world of Forex trading, understanding the dynamics of the market is essential for success. One of the most critical time frames for Forex traders is the London Kill Zone, a powerful concept within the Inner Circle Trading (ICT) methodology. This period, marked by heightened volatility and liquidity, offers a unique opportunity to capitalize on market movements. In this guide, we’ll explore the significance of the London Kill Zone, its role in ICT trading, and how traders can leverage it to boost profitability. What is the London Kill Zone…

Read MoreMaster the ICT SMT Divergence in Trading?

ICT Smart Money Technique (SMT) Divergence is a powerful concept that reveals discrepancies between correlated assets, signaling potential turning points in financial markets. By mastering SMT divergence, traders can identify and use price manipulation to their advantage. This blog post will cover everything you need to know about ICT SMT divergence. What is ICT SMT Divergence? SMT Divergence occurs when two correlated assets, observed within the same timeframe, exhibit opposing price structures. Under normal conditions, positively correlated assets, like EUR/USD and GBP/USD, move in the same direction. However, divergence happens…

Read MoreInverted Fair Value Gap-A Quick Guide

In ICT (Inner Circle Trading), understanding how price imbalances impact market movements is a valuable skill for traders. One advanced concept, the Inverted Fair Value Gap (IFVG), plays a crucial role in identifying areas of price inefficiency that may hint at potential reversals in a bearish market. By analyzing these gaps, traders can gain insight into when price action may correct, presenting strategic opportunities for entry and exit. This guide delves into the meaning, formation, and application of IFVGs within ICT, offering traders a powerful tool to enhance their trading…

Read MoreHow to Find Daily Bias in ICT Trading Explained

ICT Daily Bias is a critical tool for traders at the start of each week to determine the true direction of the market. It guides intra-day traders in identifying whether to focus on selling or buying opportunities throughout the trading week, ensuring their strategies align with the overall market trend. What is Daily Bias in ICT? ICT Daily Bias is the anticipation of price movement for the upcoming trading week. This anticipation is based on analyzing the daily timeframe to understand the market’s order flow and direction. By identifying whether…

Read MoreMastering ICT BPR in Trading

In the world of Inner Circle Trading (ICT), mastering specific concepts can give traders an edge in understanding market behavior. One such concept is the Balanced Price Range (BPR), often referred to as ICT BPR. This key element in ICT focuses on zones of price equilibrium where buyers and sellers reach a balance. Understanding and applying ICT BPR can help traders identify potential support and resistance levels, uncover market structure shifts, and spot opportunities for profitable trades. In this article, we’ll explore the significance of BPR in trading and how to leverage it for consistent gains. Importance…

Read MoreMastering NWOG in ICT Trading

In the world of Inner Circle Trading (ICT), traders use various concepts and strategies to enhance their decision-making and improve profitability. One such important concept is NWOG in ICT Trading(an abbreviation for “No Way Out Gap”). It plays a crucial role in identifying key market movements and potential trade setups. In this article, we will delve into what NWOG is, how it works, and how to leverage it in your ICT trading strategy for better results. If you’re looking to refine your understanding of NWOG ICT, this guide is for…

Read MoreICT Fibonacci Levels-A Trader’s Guide

In the world of Inner Circle Trading (ICT), understanding the concept of Fibonacci levels is crucial for traders looking to enhance their market analysis and optimize their trade entries and exits. Fibonacci retracement levels, combined with the ICT methodology, provide traders with a powerful tool for identifying potential market reversals and trend continuation zones. This ict fibonacci levels will delve into the concept of Fibonacci levels in trading, explain their application in ICT, and show you how to integrate them into your trading strategy to improve your overall market approach.…

Read More