CHoCH and BoS are two important concepts in trading. Change of Character (CHoCH) indicates that the market can change its sentiment or over all direction from bullish to bearish and vice versa. On the other hand, a Break of Structure (BoS) can be defined as when the market breaks a previous high to create a new higher high or breaks a previous low to create a new lower low. In this blog post, you will learn how to effectively apply choch and bos in trading.

What is Change of Character (CHoCH) Meaning in trading?

In trading, CHoCH refers to when the market changes its trend. For example, if the market in a particular asset class is bullish and continues making new higher highs, it might eventually reach a higher timeframe point of interest. At this point, the market can change direction and break the previous higher low with a massive price movement. This indicates that the dominance of buyers has ended, and sellers are now taking control of the market.

Finding a valid CHoCH is a trading skill. It’s not just about marking some order blocks, fair value gaps, or supply and demand zones on a higher timeframe and waiting for the market to reach those levels and reverse. Sometimes, the market traps retail traders who lack a proper understanding of market bias or true market direction. CHoCH often traps such traders when the market reverses direction and hunts their stop losses.

How to Confirm it’s a Valid Change of Character?

First, analyze the chart on the daily and weekly timeframes, and mark the Internal Range Liquidity (IRL) and External Range Liquidity (ERL). You can learn more about IRL and ERL concepts here. If the market is hunting ERL, its next target is likely IRL. This will help establish your bias for price movement.

Once you have established your trading bias on the higher timeframe (HTF), identify HTF points of interest (POI) that align with your bias. For example, if your assumption is that the market will move bullish to target ERL, you can draw a bullish order block or other POIs and wait for the price to return to your POI.

When the price reaches your POI, wait for a CHoCH (Change of Character) to occur. However, ensure this CHoCH is confirmed with a significant candle movement, often referred to as displacement. Trade this choch only when its algin with your bias. The chart below illustrate the CHoCH on EURUSD Pair.

How To Trade CHoCH?

First, you need to identify a valid CHoCH. After finding it, move to a lower timeframe and look for a Fair Value Gap (FVG). This is a three-candlestick pattern that indicates inefficient price delivery. When the price comes back to fill this inefficiency, you can execute your trades. Additionally, take advantage of Buy-Side Liquidity (BSL) and Sell-Side Liquidity (SSL) to determine your Take Profit (TP) levels.

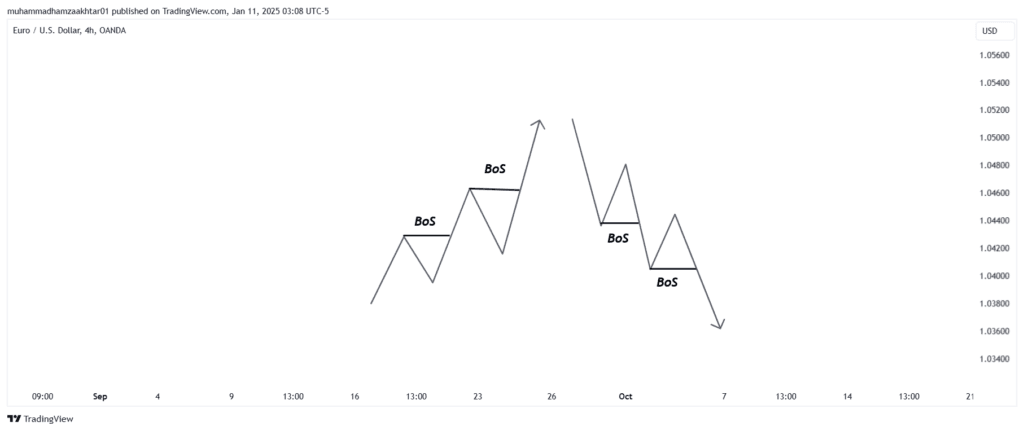

What is Break of Structure (BoS) in Trading?

A BoS happens when the market:

- Breaks a previous high and creates a new higher high, indicating a bullish continuation.

- Breaks a previous low and creates a new lower low, indicating a bearish continuation.

How BoS Differs from CHoCH?

BoS primarily signals the continuation of an existing trend. It occurs when the market breaks through a key structural level, such as a previous swing high or swing low, and establishes a new high or low in line with the current trend.

CHoCH, on the other hand, signals a potential reversal of the current trend. It represents a shift in market sentiment, where the price moves against the prevailing trend and breaks a structural level that contradicts the current trend direction.

Frequently Asked Questions

What does CHOCH mean in trading?

CHOCH stands for Change of Character, a term used in ICT (Inner Circle Trading) to describe a shift in market structure, indicating a potential trend reversal. It occurs when the market fails to make new higher highs or lower lows, signaling a change in market sentiment.

How do I use CHOCH in my trading strategy?

To use CHOCH trading meaning in your strategy, you should look for signs of market structure changes—such as the failure to form new higher highs or lower lows—and combine it with other ICT tools like Market Structure and Order Blocks to confirm the potential reversal. Once you spot a CHOCH, you can place trades in the direction of the new trend.

Can CHOCH lead to false signals?

Yes, CHOCH can sometimes give false signals, especially in ranging or choppy markets. It’s important not to rely on CHOCH alone. Combine it with additional ICT concepts like Break of Structure (BOS) and Mitigation Blocks to validate the reversal and avoid false signals.

How can I spot a CHOCH on a chart?

A CHOCH can be spotted on a chart when the price fails to break a previous higher high or lower low, signaling a potential market shift. Watch for price action on key levels of support or resistance, and confirm the signal with increased volume or other ICT indicators for higher accuracy.

Is CHOCH used for day trading or long-term trading?

CHOCH can be applied to both day trading and long-term trading, but it is particularly useful for short-term traders who need to spot trend reversals quickly. When combined with other ICT strategies, CHOCH can also help identify longer-term trend changes for swing traders and investors.