The ICT (Inner Circle Trader) Turtle Soup strategy is a renowned trading approach designed to identify and capitalize on false breakouts. By understanding this pattern, traders can enhance their ability to detect liquidity grabs and make informed decisions in the volatile world of financial markets. In this guide, we will explore the Turtle Soup strategy, its application, and tips to maximize its effectiveness.

What is the ICT Turtle Soup Pattern?

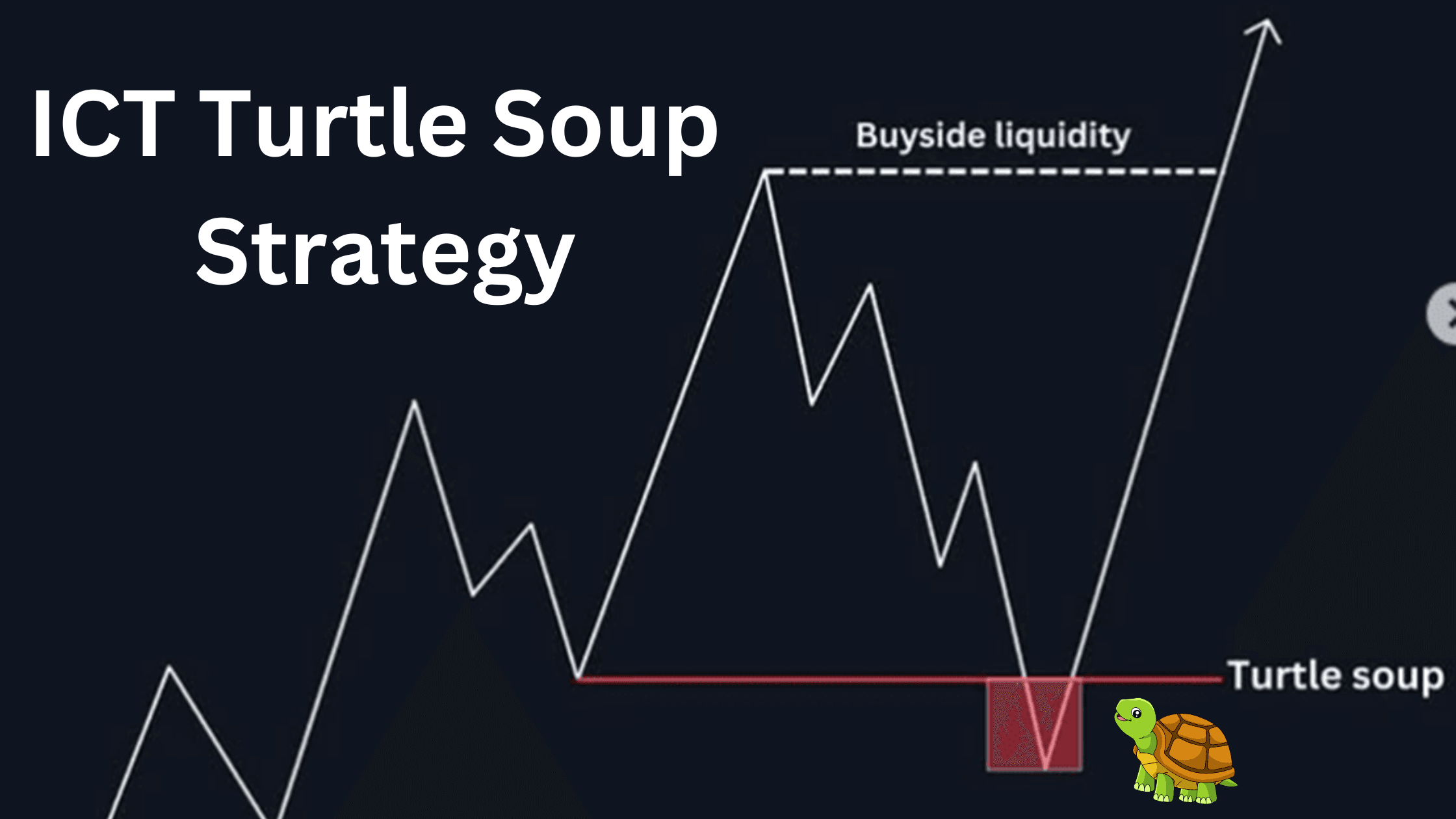

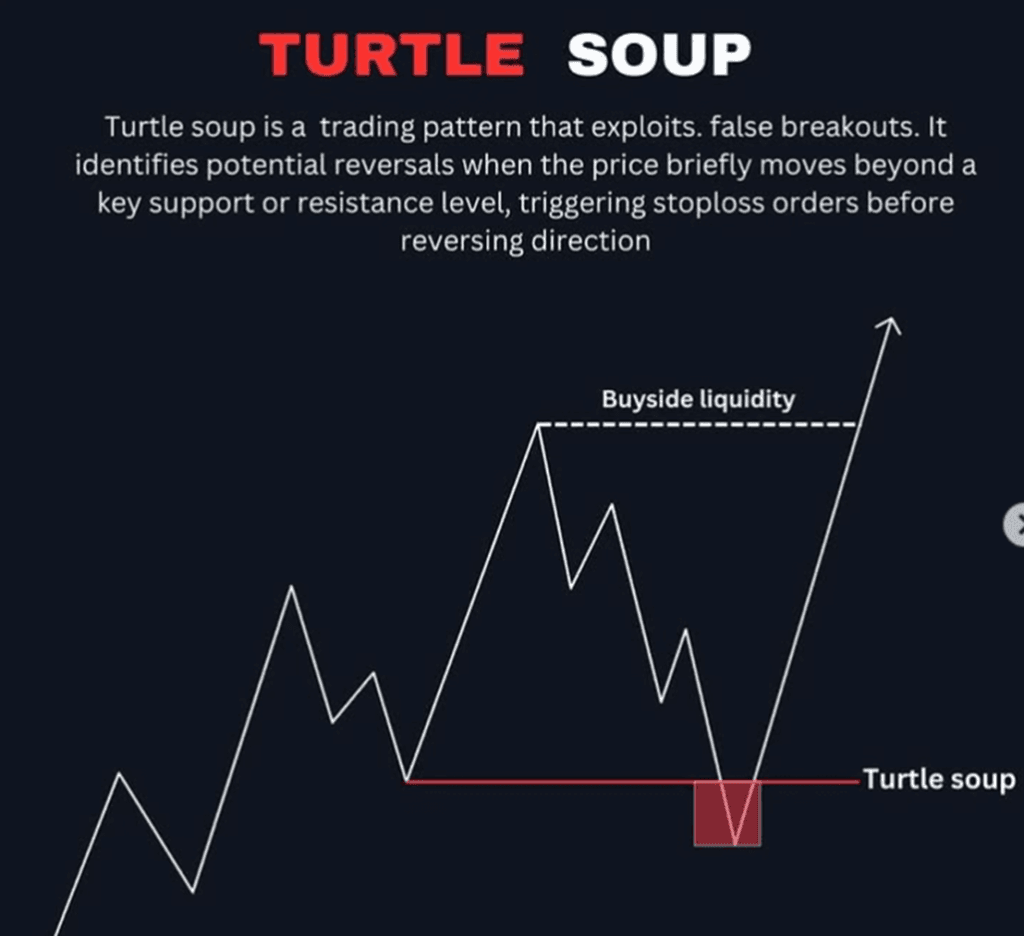

The Turtle Soup pattern is a trading strategy that focuses on false breakouts, also known as liquidity grabs. It identifies situations where the price moves beyond a key level but quickly reverses. This reversal creates an opportunity for traders to enter a position in the opposite direction of the breakout.

Key Features:

- Liquidity Grab: The price exceeds a support or resistance level, attracting traders who anticipate a breakout.

- Reversal Confirmation: After the breakout, the price swiftly reverses, trapping early entrants.

- Higher Timeframe Context: Using daily or 4-hour charts enhances the reliability of this setup.

How trade Turtle Soup Strategy?

For finding trading opportunities using ICT Turtle Soup, focus on the following key aspects:

- Determine the Direction of the Higher Timeframe

At the start of every trading week, analyze the daily and weekly timeframes to identify the overall price direction. This foundational step helps align your trades with the broader market trend. - Identify Key Liquidity Levels

Examine the chart on lower timeframes, such as hourly and 30-minute charts. Mark equal lows and equal highs, as these points are often used by retail traders and act as magnets for liquidity. Smart money deliberately moves prices to these areas to capture liquidity. - Wait for a Liquidity Hunt

Observe the market for a sweep of liquidity at the marked levels. Once liquidity is taken, wait for a market structure shift that aligns with your daily and weekly directional bias. This step confirms a potential trading opportunity in line with the higher timeframe trend. - Execute Trades Strategically

Enter your trades at any ICT Optimal Trade Entry (OTE) level or within a Fair Value Gap. This ensures precise entries with favorable risk-to-reward ratios.

Benefits of the Turtle Soup Strategy

- High Reward-to-Risk Ratio: By targeting false breakouts, traders can secure entries with minimal risk.

- Enhanced Decision-Making: Combining Turtle Soup with higher timeframe analysis improves accuracy up to 70%.

ICT Turtle Soup Bearish Trading Setup

The above DOSTUSD chart illustrates a Turtle Soup setup in a bearish scenario. The price moves above the higher time-frame key level, breaking out at 11.581. After sweeping liquidity, the price reverses direction, resulting in a Market Structure Shift (MSS) at 8.49 and leaving a Fair Value Gap (FVG).

Which Time Frame is Best for the Turtle Soup Trading Strategy?

| Time Frame | Use | Purpose |

|---|---|---|

| Higher Time Frame | Weekly or Daily Time Frame | Identify the true market direction. |

| Mid Time Frame | Hourly Time Frame | Locate key liquidity pools. |

| Lower Time Frame | 15-minute or 5-minute Time Frame | Confirm market structure shifts and determine trade entries. |

Best Time for Trading the ICT Turtle Soup Strategy

For getting optimal results, the ICT Turtle Soup strategy thrives in Kill Zones, specific time intervals when smart money injects significant volume into the market. These periods offer the best trading opportunities due to heightened activity and liquidity.

What is The Success rate of Turtle Soup Strategy

Generally, traders using this strategy report a success rate ranging from 60% to 80%, depending on how well they implement the strategy and follow the rules of the Kill Zones and other market conditions.

Why the Strategy is Named Turtle Soup

Historical Background

The name “Turtle Soup” originates from the famous Turtle Traders, a group of traders trained in the late 1980s by Richard Dennis and William Eckhardt. The Turtle Traders were taught a specific set of rules for trading, one of which focused on identifying market reversals. The Turtle Soup Pattern embodies the concept that a strong price movement, initially interpreted as a breakout, can quickly reverse. This quick reversal is metaphorically likened to “making soup” from the initial breakout, suggesting that the market can turn unexpectedly after a price surge, offering a profitable trading opportunity for those who spot the pattern.

How to Set Stop-Loss for Turtle Soup Strategy?

Place your stop-loss just below the Fair Value Gap (FVG) or a few pips beneath FVG if you are using FVG for entries into trade.

What are the main risks associated with the ICT Turtle Soup strategy

The main risks include false signals, overnight gaps, and news events.

False signals occur when a false breakout doesn’t lead to a significant reversal, with about 30% resulting in minimal price movement. This risk can be reduced by using confirmation techniques like higher timeframe bias and market structure shifts.