The ICT Market Structure Shifts (MSS) concept is crucial for traders aiming to grasp market trends and make informed decisions. By understanding MSS, traders can identify turning points in the market, determine trend direction, and enhance their trading strategies

What is ICT Market Structure Shift (MSS)?

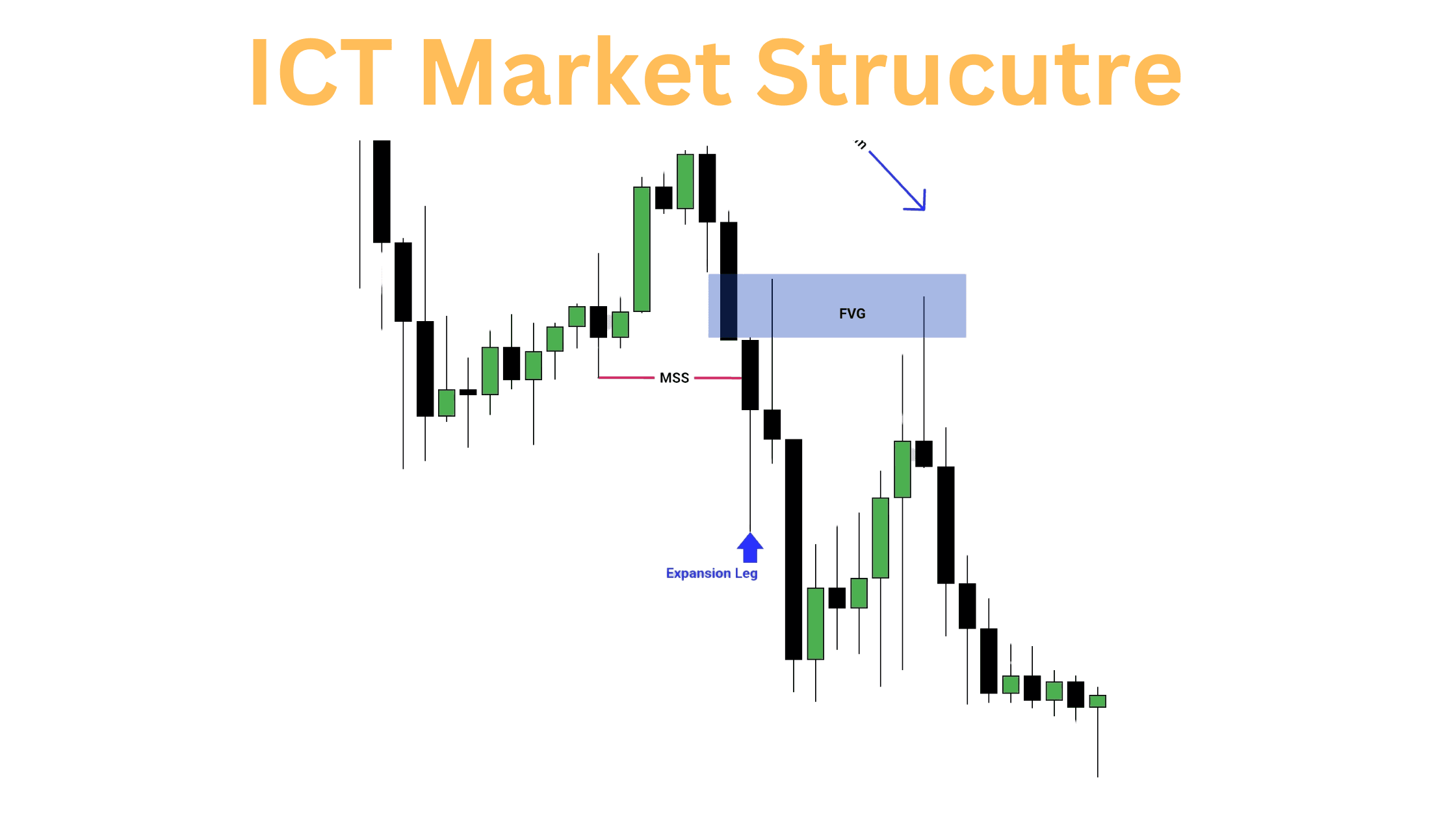

A Market Structure Shift (MSS) signifies a change in the market’s established pattern, often pointing to a trend reversal. In ICT trading, an MSS occurs when the price breaks a previous higher high (HH) or lower low (LL), signaling a potential shift in the trend’s direction.

Break of Structure (BOS):

A Break of Structure happens when the price surpasses a critical swing high or low. This movement signals the possibility of a trend reversal or continuation, marking a significant event for traders.

How to Trade ICT MSS

Trading the ICT Market Structure Shift (MSS) effectively involves waiting for the price to align with a Higher Time Frame Point of Interest (POI) before refining your analysis on lower time frames for precise entry and execution. Here’s a step-by-step guide:

1. Identify Higher Time Frame Point of Interest (POI)

Start by analyzing the Higher Time Frame (HTF) chart, such as the 4-hour, daily, or weekly. Look for key points of interest like:

- Order Blocks

- Supply and Demand Zones

- Fair Value Gaps (FVG)

- Significant Swing Highs or Lows

These zones indicate areas where the price is likely to react strongly due to institutional activity.

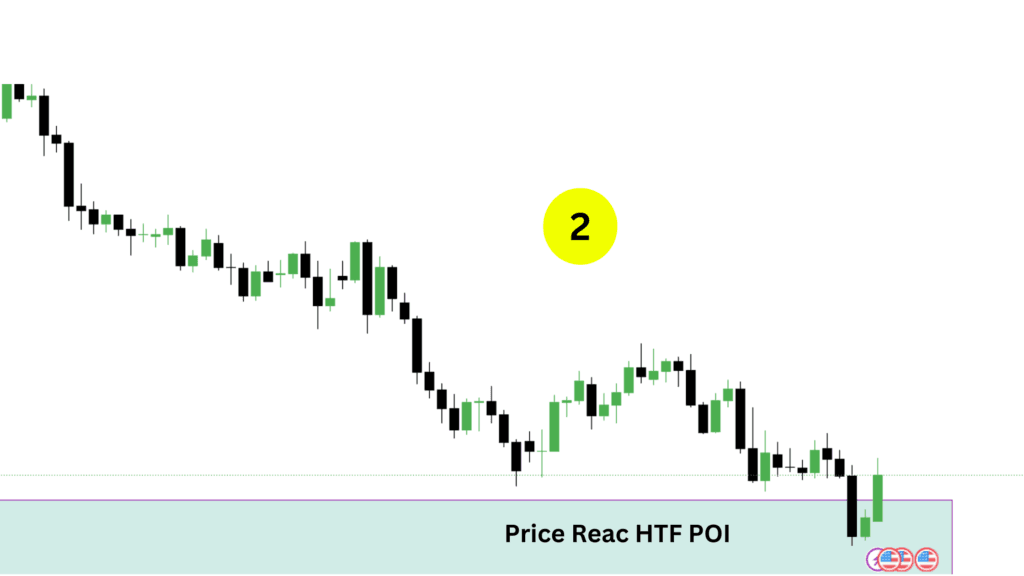

2. Wait for Price to Reach the Higher POI

Patience is critical. Allow the price to enter the HTF POI. This ensures that you’re trading in an area with a high probability of reaction.

3. Switch to Lower Time Frames (5m or 15m)

Once the price enters the Higher POI, move to a lower time frame, such as:

- 15-minute chart: Offers a broader perspective on market structure shifts.

- 5-minute chart: Provides finer details and precise entry points.

4. Look for a Break of Structure (BOS)

On the lower time frame:

- Identify a Break of Structure (BOS), where the price violates a recent swing high or low.

- An aggressive price movement after the BOS further confirms the shift in market direction and validates the setup.

5. Execute the Trade Based on Fair Value Gap (FVG)

After the BOS, watch for a Fair Value Gap (FVG) in the price action:

- Definition: An FVG is an imbalance or “gap” left in the price between a high-volume price movement.

- Entry: Place your trade at the FVG, aiming for an optimal price entry.

6. Set Target at the Next Liquidity Level

Define your target at the nearest liquidity zone, such as:

- Previous swing highs or lows

- Order blocks

- Imbalance zones

These are areas where the market is likely to gravitate, providing a logical exit point.