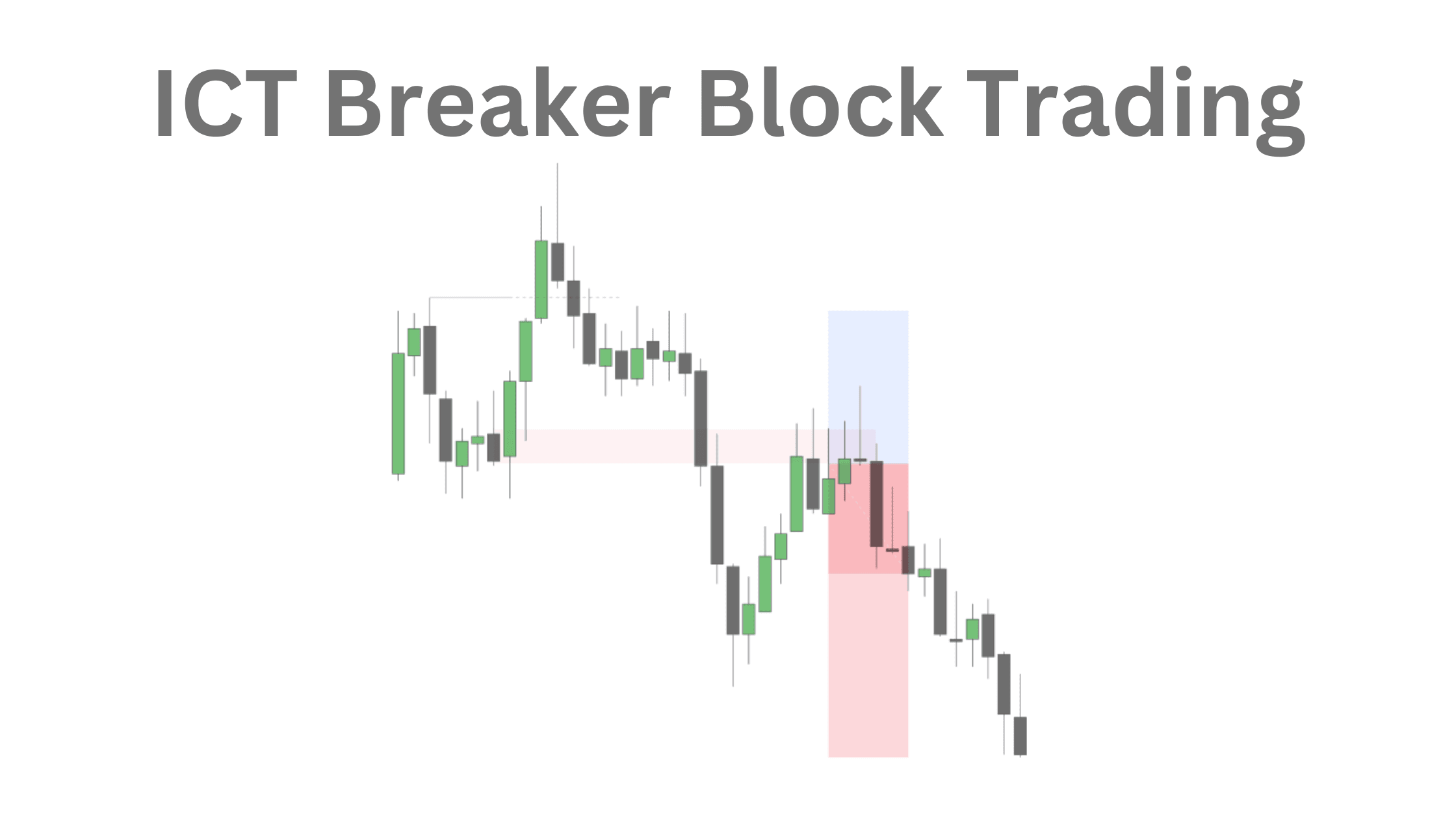

An ICT breaker block is a failed order block that signals a shift in market momentum. It is typically identified after a strong price movement where the market is unable to sustain its direction, resulting in a reversal pattern. This phenomenon highlights a change in market sentiment and provides traders with potential entry or exit signals, making it a valuable tool in technical analysis and smart money trading strategies. What is an ICTBreaker Block in Forex? An ICT breaker block, as defined by the Inner Circle Trader (ICT), is a…

Read MoreAuthor: muhammadhamza

ICT Reclaimed Order Block Theory: Definition, Examples, Trading Strategy, and Free PDF Download

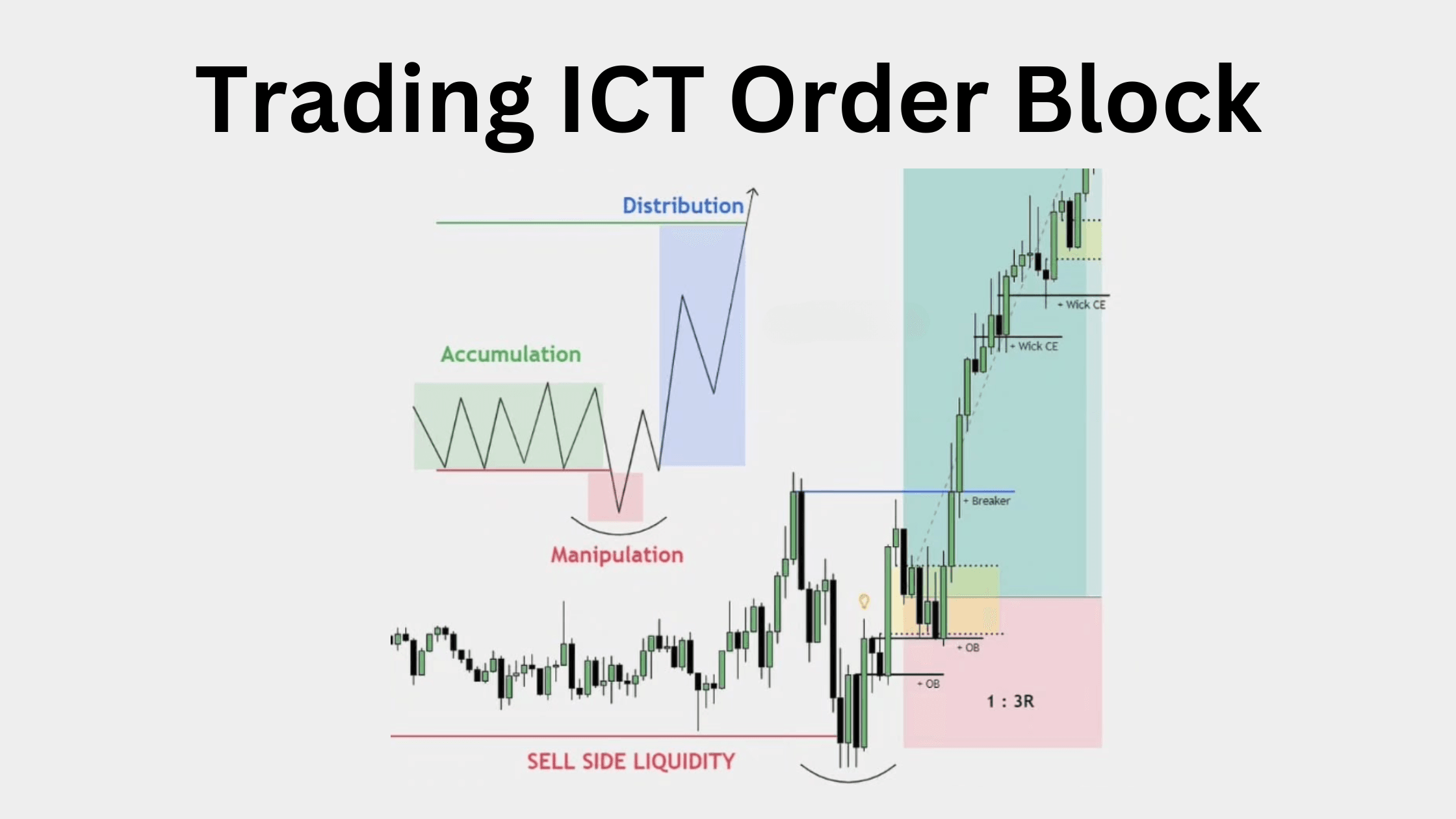

An ICT Order Block represents a change in the market’s delivery state, typically identified by specific candle formations. It’s not simply any up-close or down-close candle but rather has distinct properties: What are ICT Order Blocks? ICT order blocks are defined as the last upclosing or downclosing candle before the price shows aggressive movement. Properties of Order Block How to Find Order Blocks? One of the easiest ways to find an order block is to look for a pattern in the market. First, you’ll often see the market moving sideways…

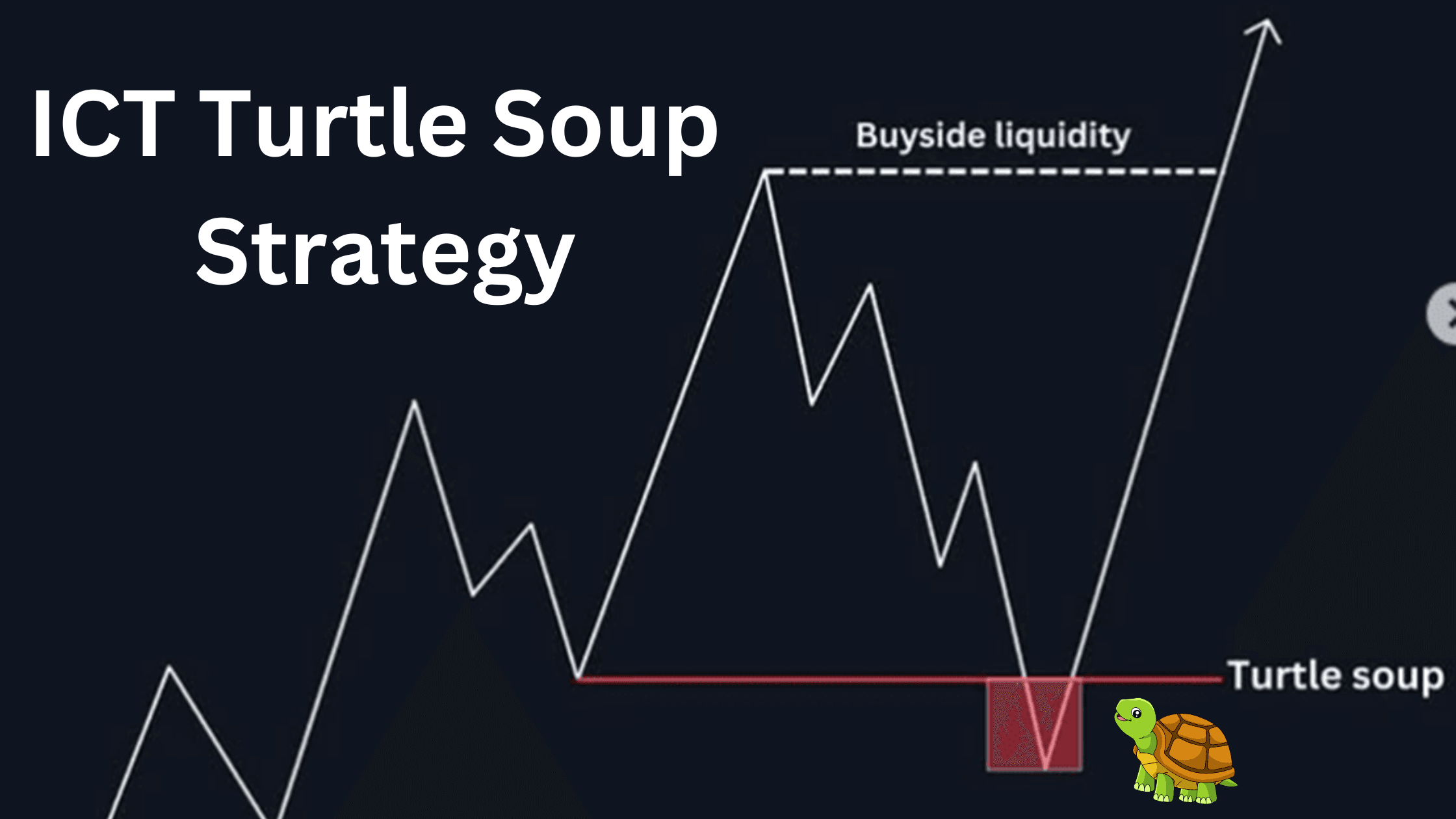

Read MoreMastering the ICT Turtle Soup Trading Strategy: A Comprehensive Guide

The ICT (Inner Circle Trader) Turtle Soup strategy is a renowned trading approach designed to identify and capitalize on false breakouts. By understanding this pattern, traders can enhance their ability to detect liquidity grabs and make informed decisions in the volatile world of financial markets. In this guide, we will explore the Turtle Soup strategy, its application, and tips to maximize its effectiveness. What is the ICT Turtle Soup Pattern? The Turtle Soup pattern is a trading strategy that focuses on false breakouts, also known as liquidity grabs. It identifies…

Read MoreICT 2022 Mentorship Notes: Episodes 1–41 PDF Free Download

The 2022 ICT Mentorship program offers an invaluable opportunity for traders to enhance their skills and deepen their understanding of the financial markets. Guided by experienced mentors, the ICT Mentorship focuses on advanced trading strategies, market structure analysis, and risk management techniques. With a focus on practical, hands-on learning, the ICT 2022 Mentorship equips traders with the tools needed to master the markets and refine their trading approach. This blog post provides an executive summary of the first 10 episodes of the ICT Mentorship 2022 program. Episode 2: ICT 2022…

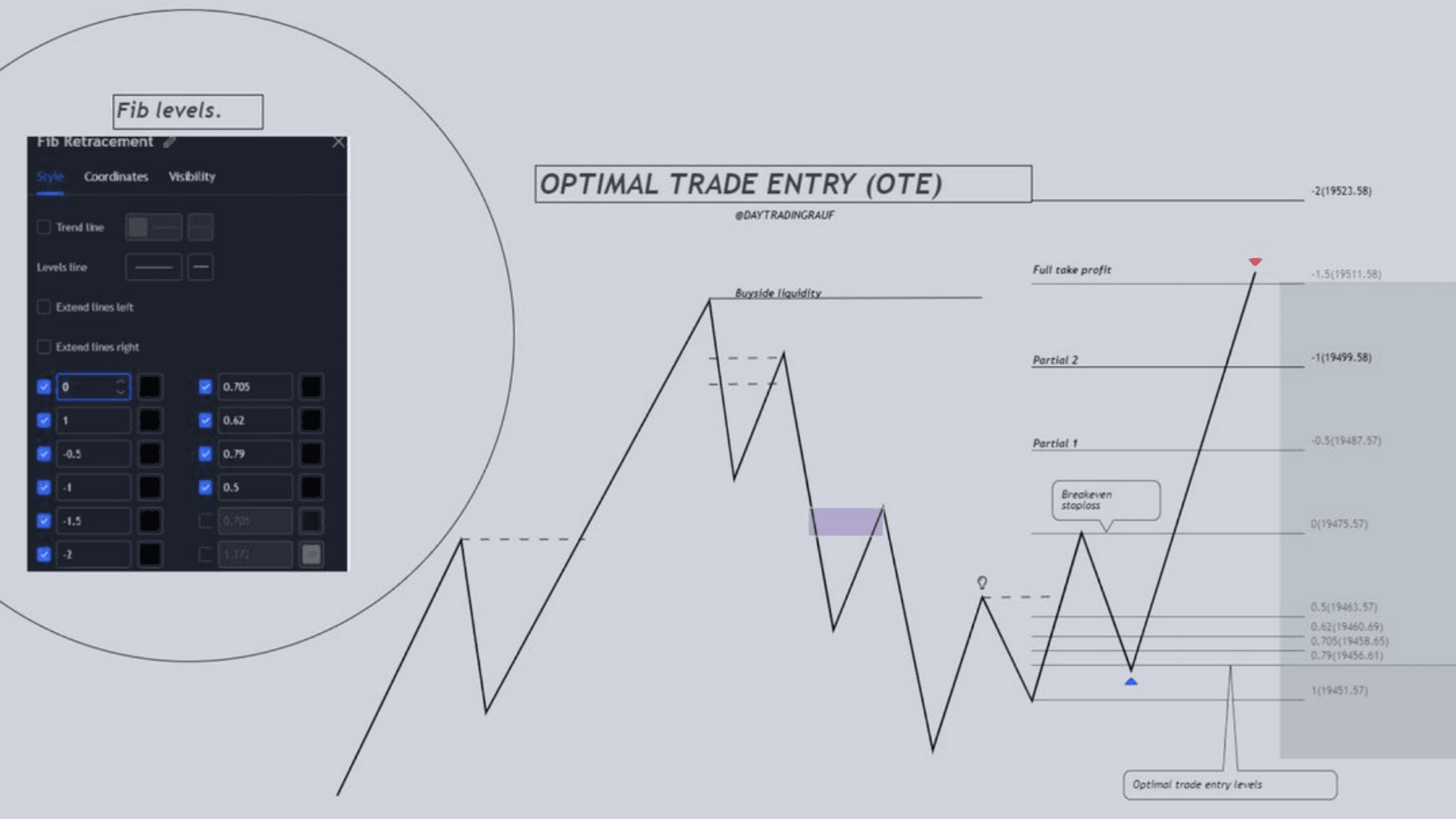

Read MoreICT Optimal Trade Entry (OTE) Fib Levels and Settings

Optimal Trade Entry (ICT OTE) refers to Fibonacci retracement levels traders use to enter long or short positions. These levels, calculated using Fibonacci ratios (e.g., 61.8%, 50%, and 38.2%), help identify strategic price points in a trending market. Markets exhibit cyclical behavior, alternating between upward (bullish) and downward (bearish) movements. Why Are Fibonacci Levels Important in a Trending Market? ICT Bullish OTE Example The below EURUSD chart explain the EURUSD Bullish OTE setup. In a bullish trend, the EUR/USD pair showed significant upward momentum by breaking the previous high at…

Read MoreWhat is CRT in ICT Trading? Candle Range Theory Explained with Strategy, Timing & PDF Guide

Candle Range Theory (CRT) is a trading concept that analyzes market movements within the price ranges of candlesticks. It is beneficial for understanding price action across different timeframes and identifying optimal trade setups. To refine trading strategies, CRT combines technical analysis principles, such as liquidity, accumulation, manipulation, and distribution phases. What is the ICT Candle Range Theory? Inner Circle Trader Candle Range Theory ICT CRT is a trading methodology centered on analyzing candlestick ranges to interpret price dynamics in financial markets. It examines the interaction between the high, low, open,…

Read MoreICT Core Content Notes – Month 1, 2, 3, 4, 5 & All 12 Months PDF Free Download

Welcome! If you’re looking to download comprehensive ICT Core Content notes in PDF format, you’ve come to the right place. I have compiled a set of concise and well-organized notes that cover all the essential topics from the ICT 20216 mentorship program. ICT Core Content Month 1 Notes ICT in the first month of 2016 mentorship teaches elements of trade setup. Basically teaches how price moves and completes its cycle. What is Expansion? Expansion occurs when the price rapidly moves away from a level of equilibrium (50% of fib), indicating…

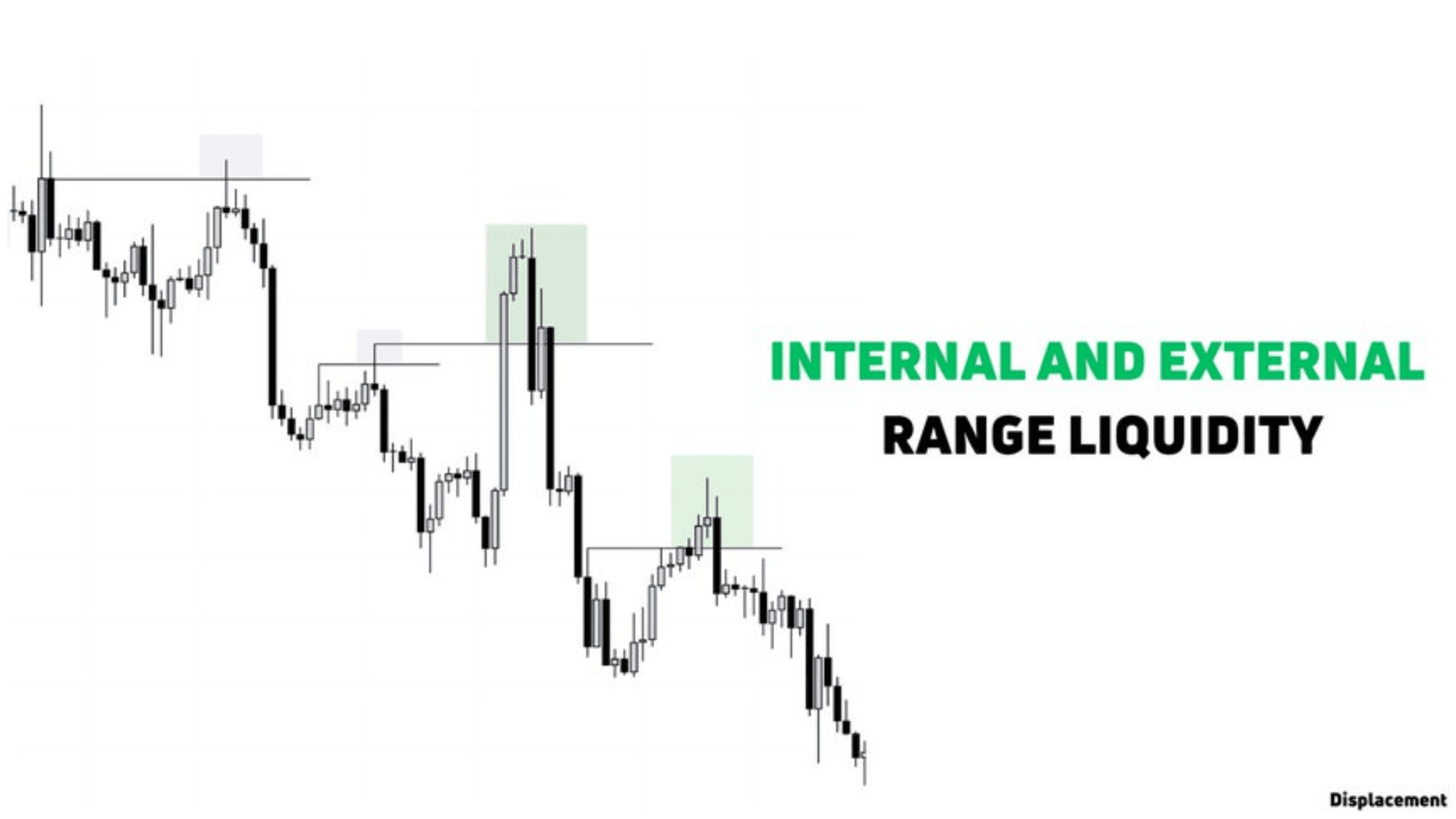

Read MoreICT Internal Range Liquidity and External Range Liquidity (IRL&ERL)

Internal Range Liquidity (IRL) and External Range Liquidity (ERL) are cornerstone concepts in building a trading framework based on ICT (Inner Circle Trader) liquidity principles. These concepts offer a comprehensive understanding of market dynamics by revealing where price originates and its likely destination. Understanding IRL and ERL allows traders to map the flow of price action systematically. When the market sweeps External Range Liquidity—the liquidity resting above swing highs or below swing lows—it often targets Internal Range Liquidity zones next, such as order blocks or fair value gaps. Similarly, after…

Read MoreICT Liquidity Trading Concept 101: A Simple Guide for Beginners

When it comes to trading, the single objective of smart money (big players) in the market is to make a profit by hunting liquidity. This is one of the most important concepts to understand in trading. As a retail trader with limited capital, it’s crucial to grasp how liquidity works and how you can use it to your advantage. In this blog post, I will explain how to make profitable trades using liquidity, the key differences between sell-side and buy-side liquidity, and much more. What is ICT Liquidity In Trading?…

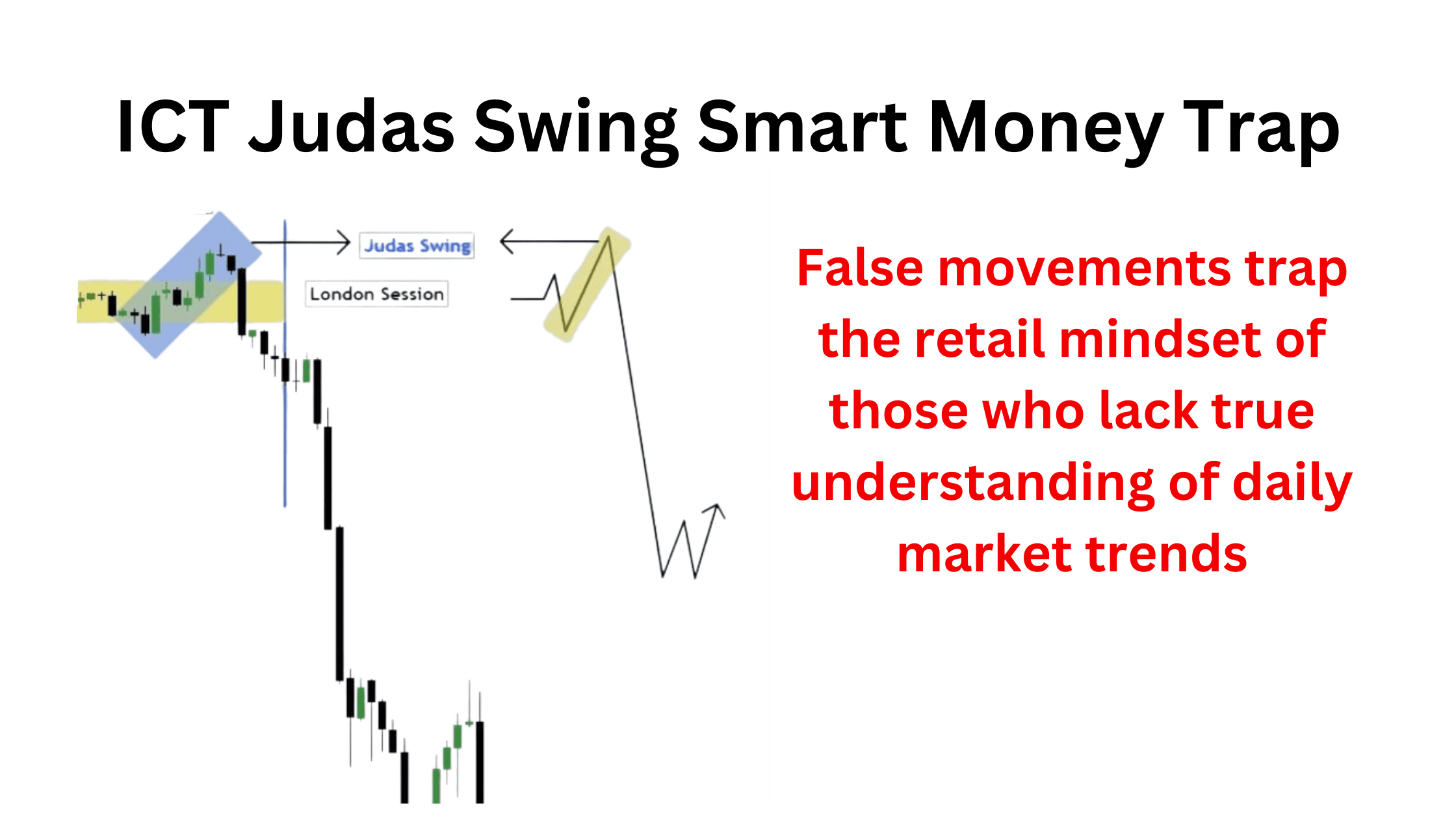

Read MoreMastering ICT Judas Swing Strategy

ICT Judas Swing refers to false market movements that trap retail traders, particularly those who lack a true understanding of daily bias. These deceptive movements often lead to misguided decisions, resulting in losses for traders who are unable to interpret the underlying market conditions accurately. What Is ICT Judas Swing? The Judas Swing is a tactic used by smart money to exploit retail traders who lack an understanding of higher time frame direction. This movement typically occurs from midnight New York local time to 5 AM New York local time.…

Read More