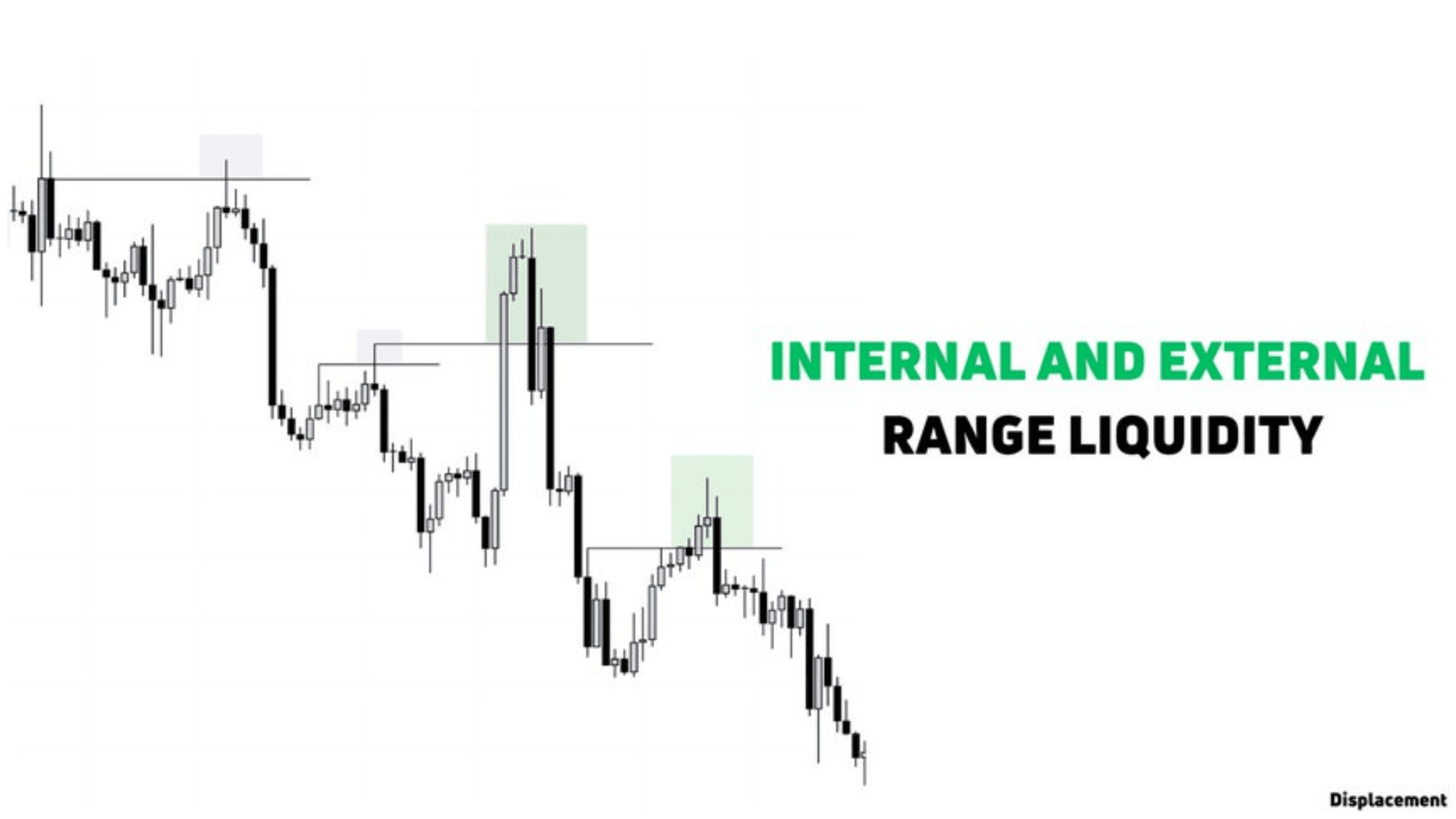

Internal Range Liquidity (IRL) and External Range Liquidity (ERL) are cornerstone concepts in building a trading framework based on ICT (Inner Circle Trader) liquidity principles. These concepts offer a comprehensive understanding of market dynamics by revealing where price originates and its likely destination. Understanding IRL and ERL allows traders to map the flow of price action systematically. When the market sweeps External Range Liquidity—the liquidity resting above swing highs or below swing lows—it often targets Internal Range Liquidity zones next, such as order blocks or fair value gaps. Similarly, after…

Read MoreCategory: ICT Concepts

ICT Liquidity Trading Concept 101: A Simple Guide for Beginners

When it comes to trading, the single objective of smart money (big players) in the market is to make a profit by hunting liquidity. This is one of the most important concepts to understand in trading. As a retail trader with limited capital, it’s crucial to grasp how liquidity works and how you can use it to your advantage. In this blog post, I will explain how to make profitable trades using liquidity, the key differences between sell-side and buy-side liquidity, and much more. What is ICT Liquidity In Trading?…

Read MoreMastering ICT Judas Swing Strategy

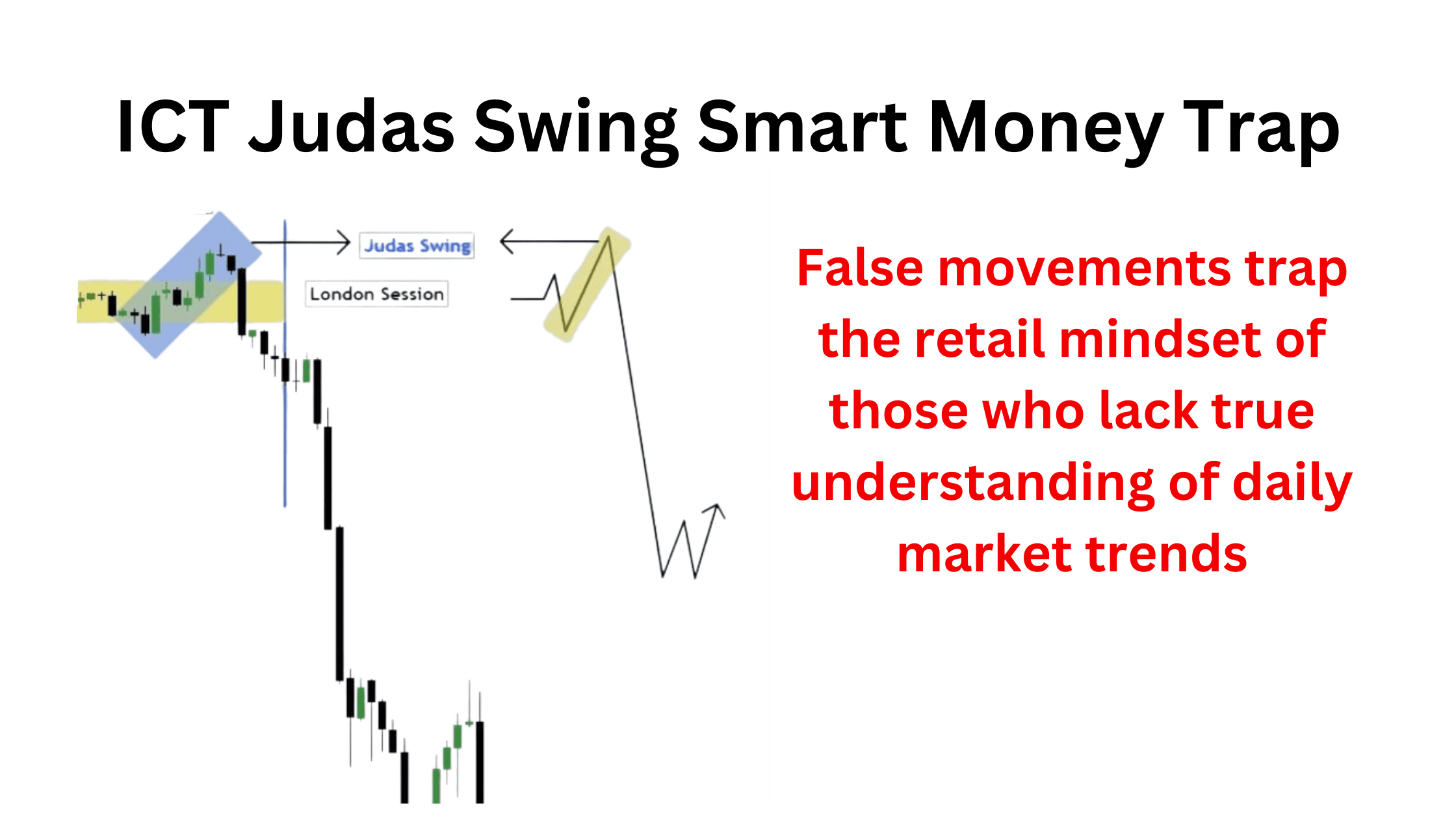

ICT Judas Swing refers to false market movements that trap retail traders, particularly those who lack a true understanding of daily bias. These deceptive movements often lead to misguided decisions, resulting in losses for traders who are unable to interpret the underlying market conditions accurately. What Is ICT Judas Swing? The Judas Swing is a tactic used by smart money to exploit retail traders who lack an understanding of higher time frame direction. This movement typically occurs from midnight New York local time to 5 AM New York local time.…

Read MoreMastering the ICT New Day Opening Gap (NDOG): A Complete Strategy Guide

If you’re exploring advanced trading concepts, understanding the ICT New Day Opening Gap (NDOG) can significantly improve your trading precision. In this guide, we’ll break down what an NDOG is, how to identify it on your chart, and how to trade it effectively using the ICT NDOG strategy. What is the ICT New Day Opening Gap? The ICT New Day Opening Gap refers to the price gap created between the market’s closing price at 5:00 PM (New York time) and the opening price at 6:00 PM (New York time) from…

Read MoreWho Is Inner Circle Trader? From Enigma to Logo and Net worth

The Inner Circle Trader, commonly referred to as ICT, is a renowned mentor in forex, trading, and cryptocurrency communities. The mastermind behind ICT is Michael J. Huddleston, who is widely regarded as a mentor to traders and the creator of Smart Money Concepts (SMC). The Core of ICT’s Teaching Methodology Michael J. Huddleston’s teaching revolves around guiding traders to understand the market by following the “footprints of smart money”—a collective term referring to large financial entities like banks, institutions, and hedge funds. His methodology equips traders with the ability to…

Read MoreMastering ICT Opening Range for Profits

n the world of Inner Circle Trader (ICT) strategies, the Opening Range Gap (ORG) is an essential concept that every trader should understand. The ORG refers to the gap that forms during the transition from the close of the previous trading day to the open of the current trading session. This gap is visible on the Regular Trading Hours (RTH) chart and represents a key market structure that can help traders identify areas of support, resistance, and liquidity. In this blog post, we’ll explore the Opening Range Gap, how it…

Read MoreICT Classic Buy Day Template Explained

In the world of trading, spotting high-probability days can dramatically enhance your trading success. Experienced traders use various techniques to pinpoint when market conditions align for optimal trades. One such strategy is the Classic Buy/Sell Day Template, which combines liquidity analysis with an understanding of session-based market behavior. In this post, we’ll explore how to identify these high-probability trading days and how to trade in sync with the market’s natural movements. 1. Understanding Liquidity Draw A key concept for identifying high-probability trading days is liquidity draw. Liquidity refers to areas…

Read Morebreak of structure and change of character

In the world of Inner Circle Trading (ICT), two essential concepts break of structure and change of character play a crucial role in identifying market trends and making trading decisions. These concepts help traders to read market movements, identify potential reversals, and predict future price action. Understanding BOS and CHOCH in depth is vital for anyone looking to enhance their trading strategies and improve their market analysis skills. What is Break of Structure in ICT Trading? Definition of Break of Structure (BOS) Break of Structure (BOS) refers to a significant…

Read MoreWhat is Change of Character (ChoCH) and Break of Structure (BOS): In Trading?

CHoCH and BoS are two important concepts in trading. Change of Character (CHoCH) indicates that the market can change its sentiment or over all direction from bullish to bearish and vice versa. On the other hand, a Break of Structure (BoS) can be defined as when the market breaks a previous high to create a new higher high or breaks a previous low to create a new lower low. In this blog post, you will learn how to effectively apply choch and bos in trading. What is Change of Character…

Read MoreMastering Algorithmic Price Delivery

In the world of ICT (Inner Circle Trading), understanding how prices move in the financial markets is crucial for success. One key concept is Algorithmic Price Delivery, which refers to how the market systematically delivers prices to specific levels, guided by algorithms. These algorithms are programmed to optimize liquidity and ensure price efficiency, making it possible for traders to predict and capitalize on market movements. By mastering this concept, you can gain a deeper insight into price delivery patterns and refine your trading strategies. Understanding Algorithmic Price Delivery in ICT…

Read More